Taxes: BEPS 2.0 – Base Erosion and Profit Tax Shifting

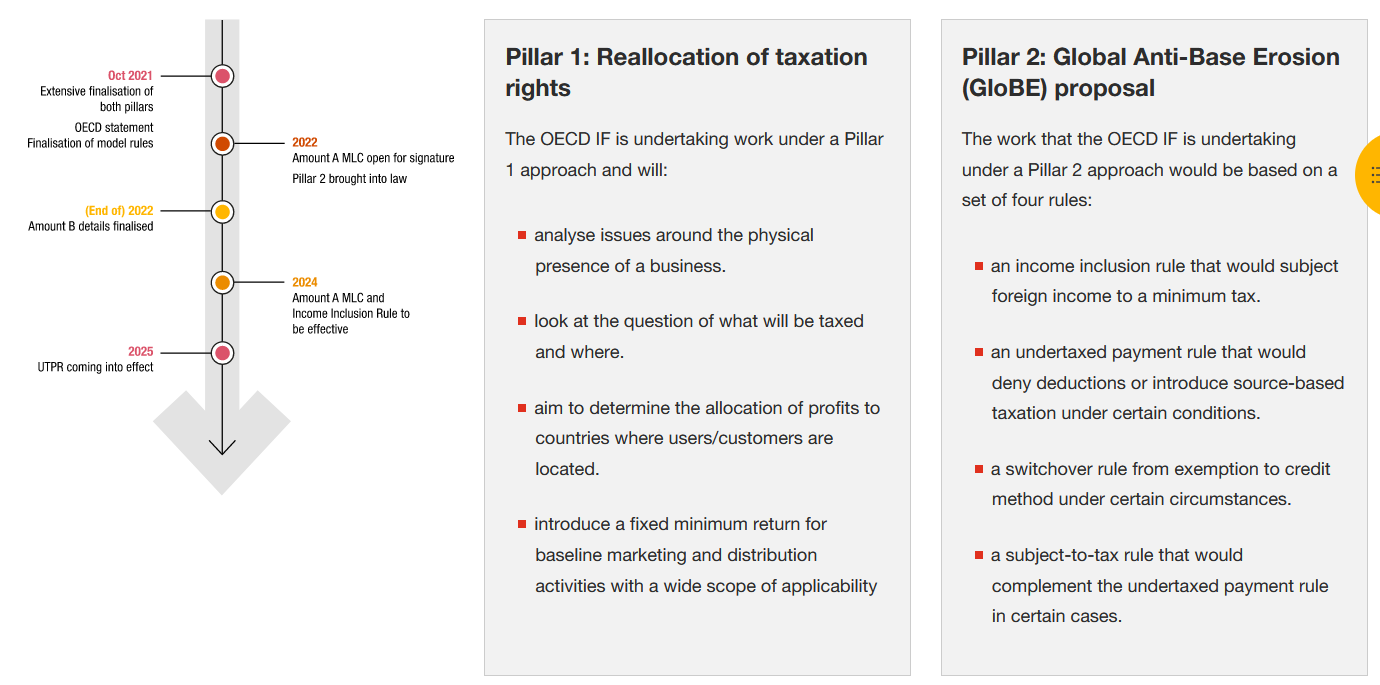

Ein Bericht von PwC. Die jahrelange Diskussion um die Besteuerung grosser internationaler Konzerne wird bald Realität. Das von der OECD vorangetriebene Projekt «Base erosion and profit shifting 2.0», besser bekannt unter dem Kürzel «BEPS 2.0» – wird zu signifikanten Umwälzungen in der Steuer- und Standortpolitik führen.

Im Bericht in deutscher Version lesen Sie zu den Topics:

- Zum Hintergrund

- Säule 2 im Überblick (Unternehmen von 750 Mio. weltweiten Umsatz)

- 15% Steuern wovon?

- Konsequenzen einer Niedrigbesteuerung

- Was bedeutet dies für die Schweiz?

- Fazit

Do you prefer English?

On 2 February 2023, the OECD released the Agreed Administrative Guidance for the Pillar Two GloBE Rules as part of the Implementation Framework. The Guidance covers 26 topics regarding Scope, Income and Taxes, Insurance companies, Transition period, and Qualified Domestic Minimum Top-up Taxes. Further Guidance can be expected to be published on an ongoing basis. The Administrative Guidance will be incorporated into a revised version of the Commentary that will be released later this year.