TOMATO CATCH-UP - Newsletter Issue 283 - January 2026

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

Each year in January, we look at a selected list of articles in our newsletter from the previous year – you can find the full list at point 3 below (to be linked).

We've also been sharing Forbes' list of New Year's resolutions for several years now. Given the wave of uncertainty in 2025, this year’s resolution is „Career Insurance: deliberate investments in your professional future that protect you regardless of what happens to your current job“. Like any successful CEO, you need to ensure you are relevant today and in the future: allocate 80% of your energy to performing well in your current role, 10% to exploring other areas or roles, and 10% to creating the future.

Martin comments: Be active and keep an eye out for changes in your company. Changes in your professional life arrive on silent paws. If you wish to be successful in your professional life in the long run, you need that time and space of 20% to rethink your career path repeatedly. Reflection worksheets are widespread on the internet – here’s a sample reflection worksheets by the US Motivational Trainer Anthony Robbins

Be wise on the so-called New Year’s Resolution plans; 80% of people give them up after six weeks. Remember to consider whether you are designing for tomorrow or just delivering for today.

WEF Davos: This week, world leaders from government, business, civil society and academia will convene in Davos to engage in forward-looking discussions to address global issues and set priorities. You can explore the key themes on the WEF webite.

This edition includes topics such as Corporate Liquidity Planning, Bank Services Globally, Risk Mitigation Accounting, SAP Treasury Consulting, Stablecoins for Treasury, EU and Global Trade, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- What Would You Improve in Corporate Liquidity Planning?

- Are You Happy with Your Bank’s Services Around the Globe?

- Tomato’s 2025 Selected Articles in Review-

- New Risk Mitigation Accounting Model by IASB

- SAP Treasury specialist Eprox Consulting celebrates 25 years

- Stablecoins Ready for Treasury?

- EU’s Role in Global Trade – 2024 Stats

- Book Tip – Equality: What It Means and Why It Matters

- Termine & Events

- From the Desk of Tomato

1. What Would You Improve in Corporate Liquidity Planning?

An article from TMI (Treasury Management International) and written by FIS: As a treasurer, you play a major, strategic role in delivering the liquidity your organization needs to do business. However, keeping money in motion is a challenge due to aging technology and inefficient manual processes.

Read details at TMI (your credentials are needed):

Comments from Martin Schneider:

- Is your company’s liquidity planning accurate? Are you satisfied with the existing liquidity forecast?

- How often do your company and corporate controllers deliver data to you as a treasurer?

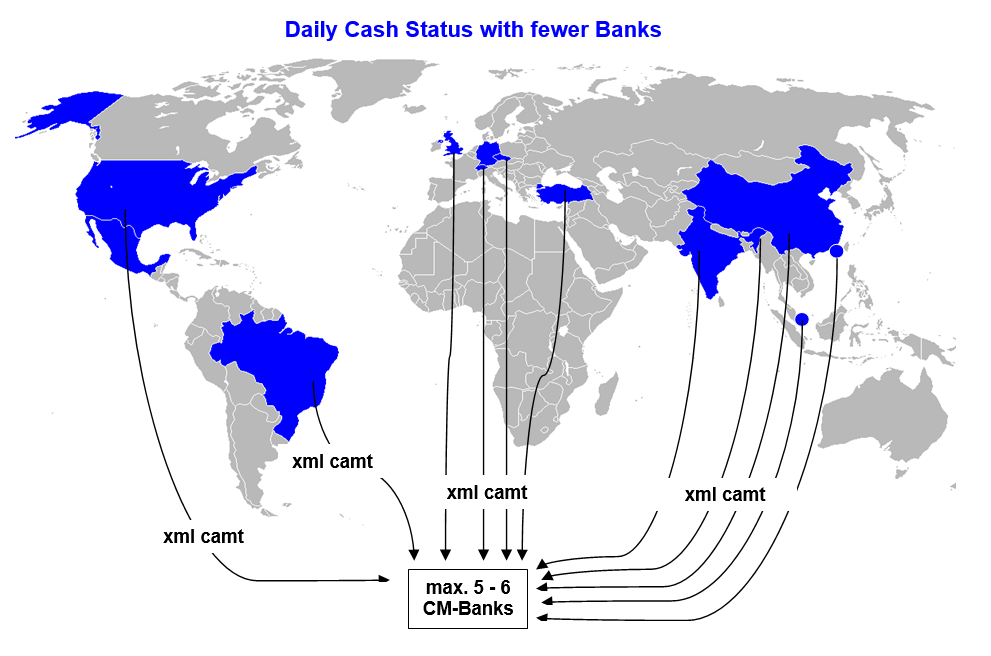

- Are you receiving a copy of all XML camt.53 worldwide (until the end of 2025 MT940)?

- Do you have company-wide end-of-day processing?

- Are all the invoices from yesterday’s suppliers ready today in your ERP? Can you have a daily report on your money spending?

- Are all customer invoices updated daily in your ERP? Do you have the incoming flows for the next weeks and months in sight?

If you want to improve or address any of the above crucial points, contact Contact Tomato Martin Schneider or by phone. Take your time for a free, non-binding Teams Meeting.

We are ready when you are and want to hear from you how you are doing.

https://www.tomato.ch/liquidity-planning.html for instant understanding click your preferred language DE or EN

2. Are You Happy with Your Bank’s Services Around the Globe?

How satisfied are you as a corporate treasurer with the services rendered by your banks worldwide? Generally, you are satisfied with your core partner banks at the headquarters or nearby regions, such as Germany, Switzerland, Austria, France, or Italy. But how do your banks perform in Southern, Northern, Eastern Europe, the Americas, or Asia?

Prices and services rendered to the treasury and to the local subsidiary are different and seldom compared or negotiated. Additionally, technical services in bank gateways or XML message types, such as camt, may differ significantly from those used in middle Europe by banks.

If you have questions or doubts about services, reliability, or costs, you need timely answers. Contact Tomato Martin Schneider or by phone and have all your doubts cleared by a non-binding Teams Meeting.

Tomato Fachbeitrag in PDF in Deutsch

Tomato Publication in PDF in English

3. Tomato’s 2025 Selected Articles in Review

Here are our selected 2025 articles in our newsletter that we believe you might want to review:

Jan NL274: Podcast: HSLU and Corporate Treasury Experience Gas & Electricity Purchasing

Mar NL275: Swift Messages Goes XML Swift die bekannten Message Types wie MT1xx, MT9xx und weitere ersetzen mit XML

Apr NL276: BEPS: Swiss Update on Taxes on Corporate Legal Entities (Base erosion and profit shifting 2.0)

Jun NL277: SOC 2 Compliance in Switzerland SOC bedeutet System- und Organisationskontrollen (SOC) gemäss Definition des American Institute of Certified Public Accountants (AICPA) ist die Bezeichnung für eine Reihe von Berichten, die im Rahmen einer Wirtschaftsprüfung erstellt werden.

Jul/Aug NL278: Tomato provides AI-solutions on Cash Forecast at Swiss-Treasurer in Lausanne

Sep NL279: Die grössten Banken weltweit und die Top-Corporate Banken in DE and also if you like to review and how to handle VoP VoP Verification of the Payee

Oct NL280: mit digitalen Prozessen bei Garantien / Avalen spart man bis 70%

Nov NL281: Intl. Payment Transfers: Can companies like Wise, Airwallex, Revolut compete with global banks?

Dez NL282: Treasury- Cash Management Salary Review in Germany

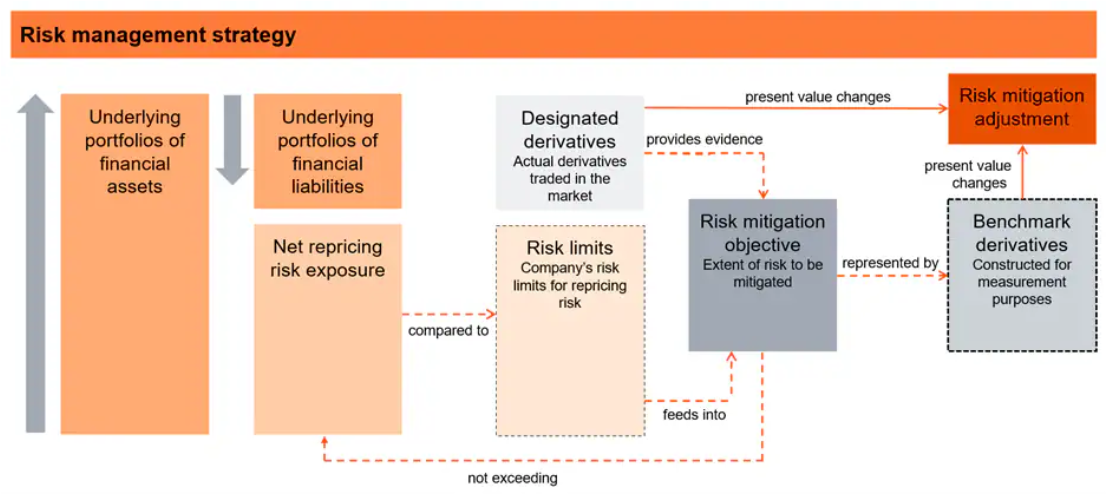

4. New Risk Mitigation Accounting Model by IASB

An exposure draft from the International Accounting Standards Board (IASB) proposes a new accounting model to more accurately represent how banks handle interest rate risk. Comments on the exposure draft are welcome through July 31, 2026. Considering this, when banks submit comments to the IASB, they are encouraged to conduct field testing of the model. The full results of these field tests may be confidentially reported to the IASB by November 30, 2026.

Like current hedge accounting under IAS 39 and IFRS 9, the application of the RMA model will be optional and will be applied prospectively. Key elements of the RMA model:

Further reading on the PwC website

5. SAP Treasury specialist Eprox Consulting celebrates 25 years

When SAP Treasury solutions are needed, we Tomato Finance+IT often teams up with the Swiss SAP Treasury specialist Eprox Consulting. Happy, happy Birthday to the EPROX Team around Krispjin Embrechts.

Some expertise corners from Eprox:

- Bank communication and payments with SAP BCM (Bank Communication Management), SAP MBC (Multi-Bank Connectivity) or other bank gateways such as Fides

- Liquidity planning with the SAP add-on Eprox-LiqManager

- SAP Cash Management (CM) and Advanced Payment Management (APM)

- Processing of bank statements and payments (SWIFT and ISO20022)

- In-House Banking with SAP: PoBo, CoBo/RoBo and internal payments (cfr. IC-netting).

- Deal entry, management and accounting integration of Treasury transactions with SAP TRM (Treasury and Risk Management)

- Full straight-through processing of 360T and Instimatch deals in SAP TRM with the SAP add-on Eprox-DealManager

Swissness in SAP-Treasury, details at Eprox Treasury Consulting and LinkedIn

6. Stablecoins Ready for Treasury?

Stablecoins sind Kryptowährungen, die an reale Werte wie den US-Dollar, den Euro oder Rohstoffe gekoppelt sind. Ein Bericht aus DerTreasurer von PwC. Merkpunkte aus dem Bericht:

- American Institute of Certified Public Accountants (AICPA) hat einen Leitfaden zur Nutzung von Asset-backed Tokens veröffentlicht, die an Fiat-Währungen gebunden sind

- Sarah Rentschler-Gerloff, Convista Beratung schätzt, dass einige US-Unternehmen auf Stablecoins als Zahlungsmittel umsteigen könnten

- Bilanzierung: „Corporates klären, ob Stablecoins je nach Verwendungszweck als Asset oder Investment verbucht werden.“

Details bei DerTreasurer Ausgabe 1 2026 auf Seite 11

Do you prefer English?

Stablecoins are cryptocurrencies that are linked to tangible assets such as the US dollar, the euro or commodities. Key points from a report from DerTreasurer by PwC in German:

- The American Institute of Certified Public Accountants (AICPA) has published guidance on the use of asset-backed tokens that are tied to fiat currencies.

- Sarah Rentschler-Gerloff, Convista Consulting, estimates that some US companies could switch to stablecoins as a means of payment.

- Accounting: "Companies must clarify whether stablecoins are recorded as assets or investments, depending on their intended use.”

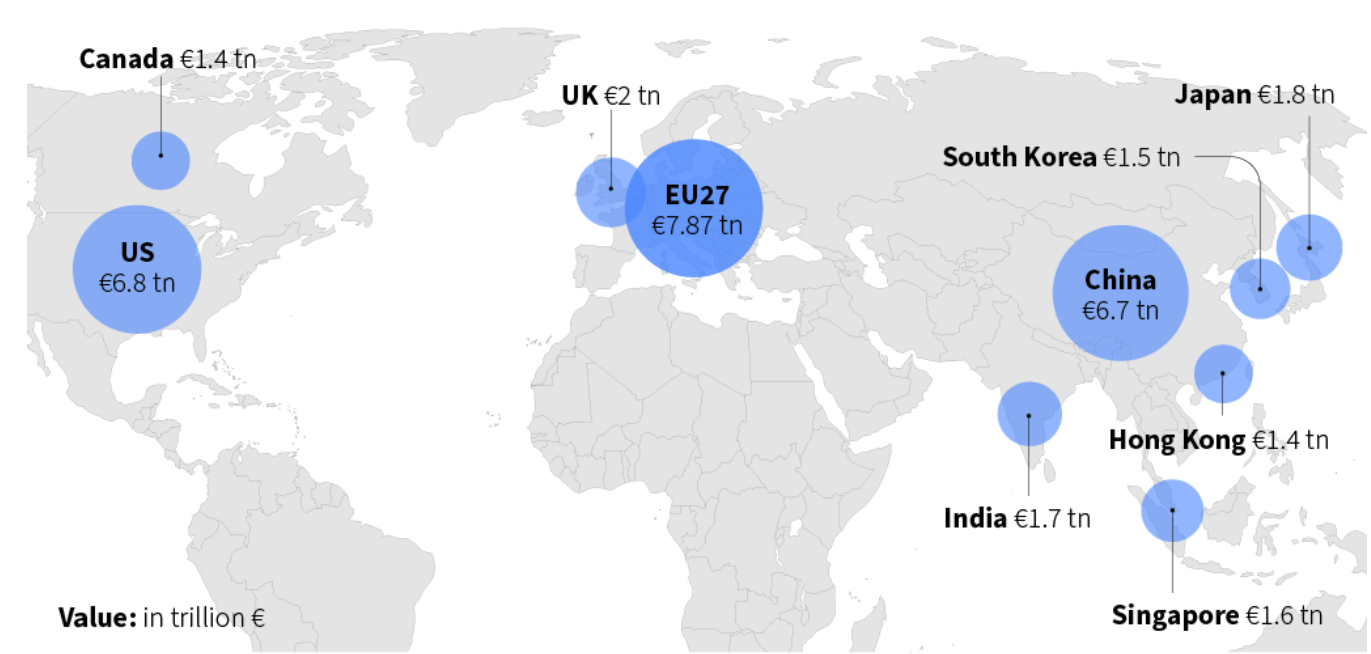

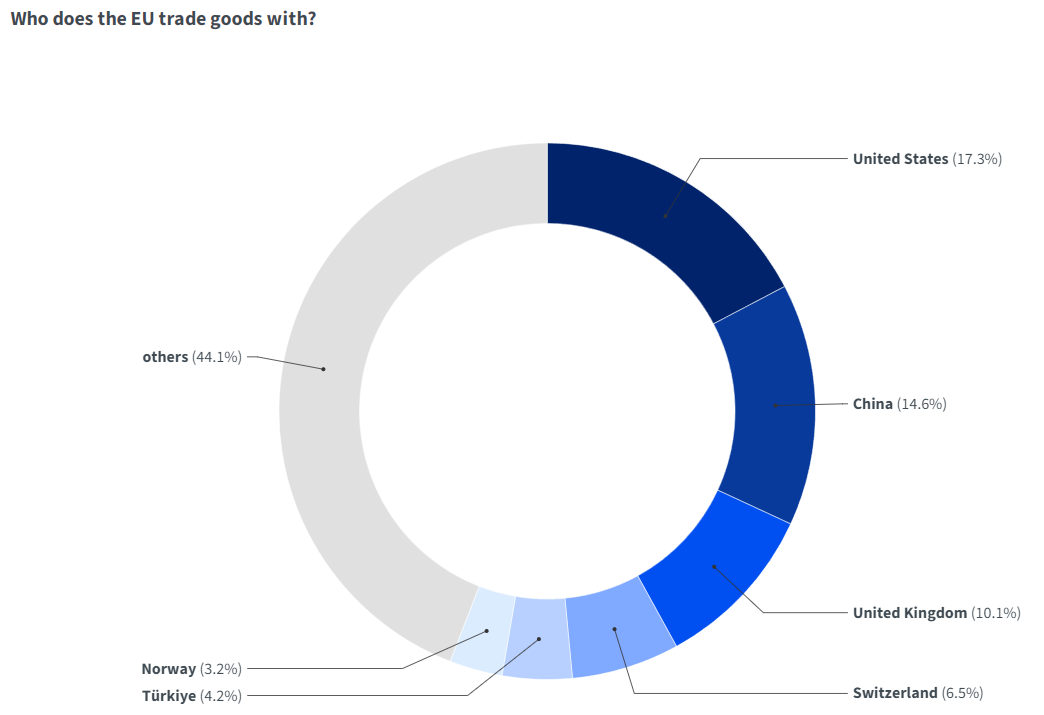

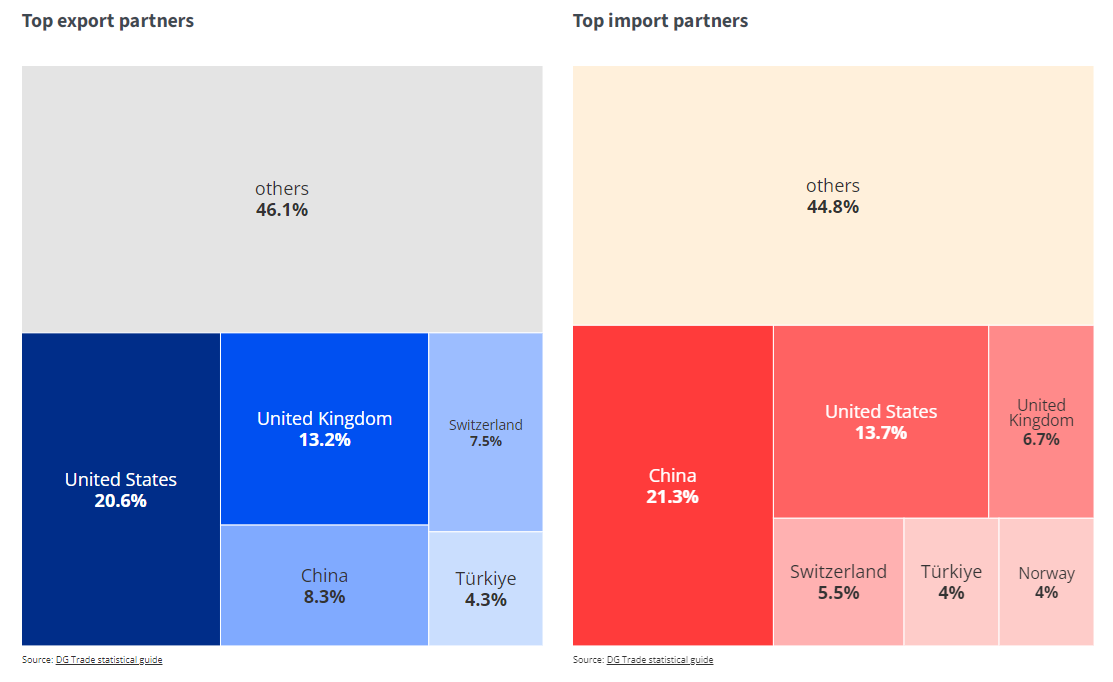

7. EU’s Role in Global Trade – 2024 Stats

In April 2025, Tomato Catch-Up News looked into the widening gap between the European and American economies.

The European Council reports the EU is the world’s largest trade bloc in terms of goods and services, accounting for an estimated 15.8% of world trade in 2024, compared to 13.6% for the US and 13.4% for China.

Other key stats:

- In 10 years EU trade in goods grew +46%, services trade +106%.

- The EU is the world’s largest trader in services, accounting for 22.8% of global trade in services. The US accounted for 14.4% of global trade in services and China for 7.6%.

- In 2023, EU companies invested over €13.4 trillion abroad while non-EU companies invested €11.52 trillion in the EU.

Further reading on the European Council website

8. Book Tip – Equality: What It Means and Why It Matters

In this book, Thomas Piketty and Michael Sandel discuss the importance of equality and what citizens and governments could do to narrow the gaps that divide us. They look into how far we have come in attaining greater equality from multiple lenses, including economics, philosophy, history, and current events. They also confront the stark differences that persist in wealth, income, power, and status.

In times of extreme political unrest and environmental catastrophe, the two writers contend that more equitable investments in health and education, higher progressive taxation, and reducing the political influence of the wealthy can all be very beneficial. Additionally, they make an effort to respond to questions like: Should we put more emphasis on social or material change? Given the resurgence of nationalist movements, what are the chances of any change at all? What role should the left play in promoting ideals like local unity and patriotism?

9. Termine & Events

- Jan 19-23, 2026: World Economic Forum 56th Annual Meeting, Davos, Switzerland

- Jan 22, 2026: PwC: Women of (SAP) Treasury, Zurich, Switzerland

- Jan 27, 2026: Payments Leaders Summit, London, UK

- Jan 30, 2026: 2026 ACT Treasury Network Scotland Dinner, Edinburgh, UK

- Feb 2, 2026: Payments Regulation and Innovation Summit 2026, London, UK

- Feb 10-11, 2026: Finnovate Europe, London, UK

- Feb 16-17, 2026: FinTech Week: Payments, Security & Beyond, Dubai, UAE

- Mar 9-10, 2026: MoneyLive Summit, London, UK

- Mar 12-14, 2026: ENBANTEC Cyber Security Conference and Exhibition, Istanbul, Turkey

- Mar 16-17, 2026: Agentic AI & Automation in Finance Summit, Atlanta, US

- Mar 17, 2026: ACT Cash Management Conference 2026, London, UK

- Mar 18, 2026: Future Identity Finance 2026, London, UK

- Mar 26, 2026: ACT Deals of the Year Awards 2025, London, UK

- Apr 14, 2026: EBINTEC Banking Innovation Conference and Exhibition, Istanbul, Turkey

- Apr 16-17, 2026: EACT Summit 2026, Brussels, Belgium

- Apr 23, 2026: Agentic AI & Automation in Finance Summit, Frankfurt, Germany

- Apr 23, 2026: Treasury 360° Nordic 2026, Gothenburg, Sweden

- May 12, 2026: ENBANTEC Cyber Security Conference and Exhibition, Istanbul, Turkey

- May 12-13, 2026: ACT Annual Conference 2026, Liverpool, UK

- May 19-22, 2026: European Identity and Cloud Conference 2026 (EIC 2026), Berlin, Germany

- Jun 11-13, 2026: CEE Treasury Forum 2026, Siofok, Hungary

10. From the Desk of Tomato

We’ve come across When Women Win, a podcast that redefines how women’s stories are told – unfiltered and deeply human. The show, which is hosted by corporate strategist Rana Nawas, highlights remarkable women who are changing the rules of society, business, and culture.

From global leaders like Kristalina Georgieva (IMF Managing Director) and Bozoma Saint John (former Netflix and Uber CMO) to cultural icons such as Hala Gorani (CNN Correspondent) and Ibtihaj Muhammad (Olympic medalist), each episode reveals hard-won knowledge and useful tools for both professional and personal development.

The podcast is ranked the #1 business podcast in the Middle East on Apple, featured on CNN, aired on Emirates Airlines flights, and draws millions of listeners in over 180 countries.

Below, find three episodes I listened on a flight, feature Kristin Lemkau at that time Chief Marketing Officer for JPMorgan Chase, Kristalina Georgieva, the Managing Director of the International Monetary Fund or also Supercar Blondie Alexandrea Hirschi originally from Australia living in Dubai where she portraits super cars. Alex Hirschi has more than twenty million followers on her YouTube channel.

Rana Nawas Podcast Episode 66 with Kristin Lemkau: Chief Marketing Officer of JP Morgan Chase

Rana Nawas Podcast Episode 74 with Kristalina Georgieva: Managing Director of the IMF

Enjoy from the Tomato Team