TOMATO CATCH-UP - Newsletter Issue 284 - February 2026

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

Here at Tomato, we've had a smooth start into 2026. For me, it's not just snowboarding and skiing that I long for; I also miss the beginning of winter and the crisp mountain air. The Winter Olympics keep me and Esra Kummer at screen. Depending on your location, the centuries-old tradition of Fasnacht/Carnival, which celebrates the end of winter, can serve as an enjoyable escape from the daily grind. How are the final weeks of winter treating you?

This edition includes topics such as Tomato Brown Bag Lunch for 2026 contact us for your interest in your city, Top Partner Banks worldwide and in Germany, Swiss Banking Map, Swiss M&A Trends, ESTV New Site, Davos 2026, Treasury Profession, Payment Reconciliation, Outplacement/Career Transition, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Tomato Brown Bag Lunch im 2026

- Der Treasurer und Treasury Vakanz im Tirol

- Schweizer Banken-Trendkarte 2026

- Top Corporate German and Worldwide Banks

- Swiss M&A SME Trends

- Neue Site der Schweizer Steuerverwaltung

- Four Takeaways from Davos 2026

- Book Tipp – Payment Reconciliation: Transparenz und Kontrolle bei bargeldlosen Zahlungen

- Termine & Events

- From the Desk of Tomato

1. Tomato Brown Bag Lunch im 2026

Auch für 2026 organisieren wir wieder die beliebten Tomato Brown Bag Lunches. Ein Zusammentreffen zur Mittageszeit von 12 bis 13.30 Uhr von Treasurers und Finance Mitarbeitern in mehreren Regionen der Schweiz, angrenzendes Deutschland und Österreich.

Hast du Interesse in deiner Region sich zu treffen? Melde dich bei Martin Schneider.

Gemeinsam planen wir die Lunch Gespräche im kleinen Rahmen von 6-8 Personen in deiner Region. Interesse und Anmeldungen für die Teilnahme im laufenden Jahr oder auch wer Gastgeber sein möchte für die 2 Stunden, macht Email Kontakt zu Martin Schneider oder ruft an bei +41 44 814 2001.

Wir freuen uns auf den Kontakt. Details bei Tomato: https://www.tomato.ch/brown_bag_lunch.html

Do you prefer English?

We are once again organising the popular Tomato Brown Bag Lunches, held in German and French. These are lunchtime get-togethers (6-8 people) for treasurers and finance staff in several regions of Switzerland, neighbouring Germany and Austria. If you are interested in participating this year or would like to host one of these two-hour meetings, please email contact Martin Schneider or call at +41 44 814 2001.

Read details at Tomato: https://www.tomato.ch/brown_bag_lunch_e.html

2. Der Treasurer und Treasury Vakanz im Tirol

Was macht ein Treasurer erfolgreich? Der Treasurer ein überzeugender Kommunikator und gleichzeitig ein Zahlenmensch. Ein Treasurer kennt alle grösseren Firmen-Geldflüsse gruppenweit und arbeitet mit allen internen Stellen zusammen. mit dieser Übersicht und Informationen beginnt die Treasury Tages- Mittel-bis Lang-frist Arbeit. Zudem hat er sich seit Jahren eine IT- und Prozess-Affinität angeeignet.

Aufgaben in der Übersicht:

- Cash- und Risiko Management

- Liquiditäts-Management

- Lange und kurze Unternehmensfinanzierung

- finanzwirtschaftliches Risiko-Management in Zinsen und Währungen

- Asset und Kredit-Management

- IT-Affinität, damit Zahlenveränderungen in Treasury- und verwandten Systemen zeitnah der Geschäftsführung präsentiert werden können.

- TMS- ZVS-Cash-Forecast-Systeme sind die Basis globale Übersicht und des Reportings

Die konstante Weiterbildung im DACH-Raum bei der CH HSLU, der AT ACTA, dem DE VDT tragen dem Renommee des Berufes bei.

Genau diese obigen Herausforderungen sind bei Tomato’s Kunden im Tirol wichtig. Die Treasury sucht Verstärkung. Bist du der Kandidat? Details zum Treasury in Tirol

more insightful treasury shirts :-)

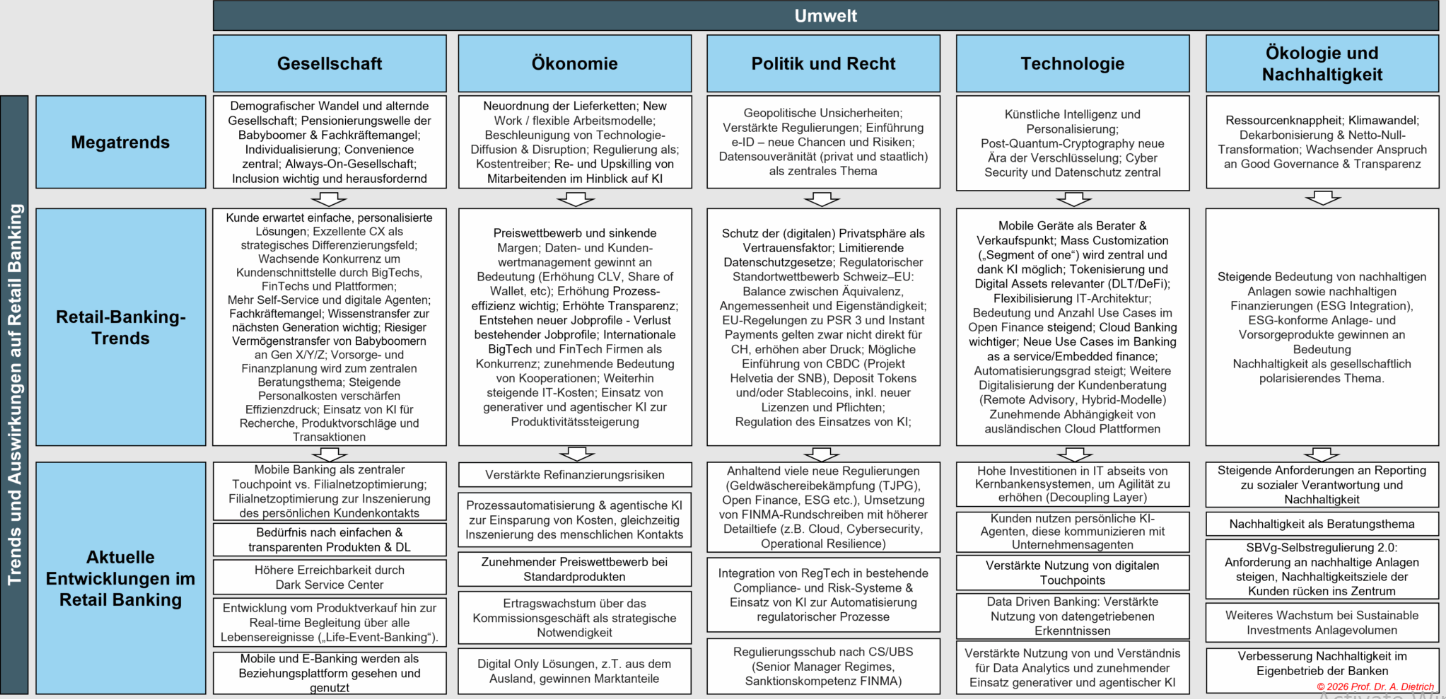

3. Schweizer Banken-Trendkarte 2026

Ein Bericht der HSLU / IFZ. Die Schweizer Banken stehen laufend vor strukturellen, technologischen und regulatorischen Veränderungen. Die IFZ-Retail-Banking-Trend-Map wurde unter Prof. Dr. Andreas Dietrich aktualisiert und weiterentwickelt. Sie beleuchtet die grossen Trends, die den Schweizer Bankensektor prägen, und identifiziert, welche Entwicklungen für die strategische Ausrichtung der Banken besonders relevant sind. Die Karte wurde erstmals 2012 veröffentlicht und 2022 aktualisiert.

Details der Bild Tafel und Tabelle

4. Top Corporate German and Worldwide Banks

Article for Corporates for German Banks in German at DerTreasurer, based on Crisil Coalition Greenwich research. https://coalitiongreenwich.crisil.com/

Methodology: From April to November 2025, Crisil Coalition Greenwich conducted interviews with 700 to 900 corporations worldwide with more than 2bln USD turnover. FYI, Tomato serves clients in the range of 200 mln to 2 bln.

For Asia, named banks in various services are: DBS, HSBC, ANZ Bank, and JP Morgan.

For Europe, named banks in various services are: BNP for Penetration, Cash Management Corporate Banking, and JP Morgan in Cash Management.

For the US, named banks in various services are: Bank of America, Goldman Sachs, J.P. Morgan, Mizuho in Corporate Banking, BoA, and JP Morgan for Cash Management.

Details in English at Crisil Coalition Greewich

Bevorzugen Sie Deutsch für den Bericht mit den besten Banken in Deutschland?

DerTreasurer bespricht sich mit diesen Top-Banken:

- Deutsche Bank

- Commerzbank

- Unicredit

- BNP Paribas

- HSBC

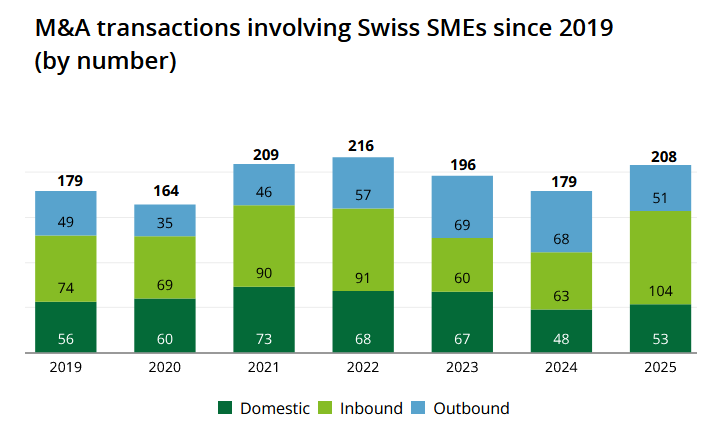

5. Swiss M&A SME Trends

A report from Deloitte in English, German and French.

2025 wurden 104 Schweizer KMU von ausländischen Investoren aufgekauft. 65% mehr als 2024 viele mehr seit 2013. Das Beratungsunternehmen Deloitte erhob 2013 erstmals die Daten zu Zukäufen und Verkäufen von hiesigen KMU. Als KMU gelten bei Deloitte Firmen mit mehr als 10 Millionen Franken Umsatz, aber weniger als 250 Mitarbeitern. Der Firmenwert muss zudem zwischen 5 und 500 Millionen Franken liegen.

Vier von fünf Investitionen kommen von Europäische Firmen. US-Investoren waren 2025 zurückhaltend. Die grösste Gruppe sind Französische Käufer mit 27%, gefolgt von Deutschen Investoren mit 19%. Stärker vertreten sind Investoren aus dem restlichen Europa, wie auch aus den nordischen Ländern.

Im Bereich Outbound schreibt Deloitte, haben in 2025 51 Schweizer Investoren eine Firma im Ausland gekauft. Dies sind 25% weniger als 2024.

Details in Deutsch ; Details en Français

Do you prefer English?

In 2025, 104 Swiss SMEs were acquired by foreign investors. That is 65% more than in 2024 and many more than in 2013. The consulting firm Deloitte collected data on acquisitions and sales of local SMEs for the first time in 2013. Deloitte defines SMEs as companies with revenues of more than CHF 10 million but fewer than 250 employees. The company value must also be between CHF 5 million and CHF 500 million.

Four out of five investments come from European companies. US investors were cautious in 2025. The largest group is French buyers with 27%, followed by German investors with 19%. Investors from the rest of Europe and the Nordic countries are more strongly represented.

In the outbound sector, Deloitte writes that 51 Swiss investors will have purchased a company abroad by 2025. This is 25% less than in 2024.

6. Neue Site der Schweizer Steuerverwaltung

Die Website der Eidgenössischen Steuerverwaltung (ESTV) präsentiert sich neu. Der Auftritt wurde modernisiert und an aktuelle technische und gestalterische Standards angepasst. Die Website ist weiterhin unter www.estv.admin.ch abrufbar. Die gespeicherten Links werden auf die neue Website weitergeleitet. Die Site ist vier sprachig: DE, IT, FR, EN.

7. Four Takeaways from Davos 2026

The 56th Annual Meeting, which had as its topic "A Spirit of Dialogue," brought together almost 3,000 leaders from over 130 nations (of which 60 heads of state and a record 400+ political leaders and 830 CEOs and Chairs) to discuss innovation and collaboration, investing in people, finding new growth opportunities, and creating shared prosperity within global borders.

Here are the key takeways:

- New deals, new dynamics: Trump’s changed stance on Greenland, EU’s stance on building a new independent Europe and historic free trade agreement with India.

- A reckoning for humanity: Christine Lagarde warned that "we are heading for real trouble" if we don't pay attention to the distribution of wealth and the disparity that is getting "deeper and bigger". She urged leaders to think very carefully about the people - and "distinguish the signal from the noise" in terms of what the numbers show. Public debt and the need for humanitarian aid loomed large. Kristalina Georgieva, Managing Director of the IMF, reminded her audience that some developing countries are spending more on debt repayments than on healthcare and education - and urged them to restructure debt. NVIDIA's Jensen Huang said AI is likely to close the technology divide.

- Dialogue does move the dial: the consensus was that we need to embrace dialogue and cooperation and embrace international, multilateral organizations like the World Bank and the IMF "because uncertainty requires these kinds of institutions to provide support".

- Living the questions: Unlike previous years, this Davos was framed around 5 defining questions: How can we cooperate in a more contested world? How can we unlock new sources of growth? How can we better invest in people? How can we deploy innovation at scale and responsibly? How can we build prosperity within planetary boundaries?

Further reading on the WEF website: https://www.weforum.org/stories/2026/01/4-takeaways-from-davos-2026/

On the WEF website, you can also find a closing 4-minute film

McKinsey offers a full highlights 16-minute podcast

8. Book Tipp – Payment Reconciliation: Transparenz und Kontrolle bei bargeldlosen Zahlungen

Dieses Buch wurde uns Tomato von unserem Partner Abrantix in Zürich empfohlen. Es richtet sich an Personen, die Kreditkartenprozesse von A bis Z verstehen wollen.

Bargeldlose Zahlungen sind vordergründig einfach. Diese Zahlungen sind im B2C (Business zum Kunden), ein komplexes Zusammenspiel aus technischen Prozessen in maximaler Geschwindigkeit, in Datenabgleich und finanziellen Risiken. Das Verständnis für diese Prozesse hilft, Fehler und Verluste zu vermeiden, Zeit zu sparen und die Wettbewerbsposition eines Unternehmens zu stärken.

Sie lernen, wie Kartenzahlungen im Detail funktionieren, wie Sie Transaktionen zwischen POS-System, dem Zahlungsanbieter und dem Bankkonto reconcilen. Sie erkennen Unstimmigkeiten sofort und minimieren Risiken. Die Prozesse werden sicher. Das Audit ein Kinderspiel.

Do you prefer English?

You will learn how card payments work in detail and how to reconcile transactions between the POS system, the payment provider, and the bank account. You will recognize discrepancies immediately and minimize risks. The processes become secure. Auditing becomes a breeze.

Das Buch bestellen Sie bei Abrantix Zürich (softcover, e-Book, audiobook)

9. Termine & Events

- Mar 9-10, 2026: MoneyLive Summit, London, UK

- Mar 12-14, 2026: ENBANTEC Cyber Security Conference and Exhibition, Istanbul, Turkey

- Mar 16-17, 2026: Agentic AI & Automation in Finance Summit, Atlanta, US

- Mar 17, 2026: ACT Cash Management Conference 2026, London, UK

- Mar 18, 2026: Future Identity Finance 2026, London, UK

- Mar 26, 2026: ACT Deals of the Year Awards 2025, London, UK

- Apr 14, 2026: EBINTEC Banking Innovation Conference and Exhibition, Istanbul, Turkey

- Apr 16-17, 2026: EACT Summit 2026, European Corporate Treasurers in Brussels, Belgium

- Apr 23, 2026: Agentic AI & Automation in Finance Summit, Frankfurt, Germany

- Apr 23, 2026: Treasury 360° Nordic 2026, Gothenburg, Sweden

- Mai 6-8, 2026 Finanzsymposium by SLG Wien, neu nun in Wiesbaden in Deutsch

- May 12, 2026: ENBANTEC Cyber Security Conference and Exhibition, Istanbul, Turkey

- May 12-13, 2026: ACT Annual Conference 2026, Liverpool, UK

- May 19-22, 2026: European Identity and Cloud Conference 2026 (EIC 2026), Berlin, Germany

- Jun 10, 2026: ACTA in Wien, Mitgliederversammlung, in Deutsch

- Jun 11-13, 2026: CEE Treasury Forum 2026, Siofok, Hungary

- Jun 19, 2026 SwissTreasurer Forum & Assembly General 2026 à Géneve en Français

- Sep 15, 2026: Swiss Treasury Summit 2026 by HSLU in Rotkreuz Lucerne in Deutsch

- Oct 7-9, 2026 Alpbacher Finanzsymposium, Tirol Österreich in Deutsch

- Nov 25-26, 2026 Structured Finance, Stuttgart, in Deutsch

10. From the Desk of Tomato

Outplacement: A Chance or a Burden?

Thank you for your feedback! In Tomato’s intro NL Jan-2026, we suggested you set aside 10-20% of your time to market yourself and your professional experience, and to always be prepared for professional changes.

I met with Finance and Treasury colleagues on “Garden Leave” (bezahlte Freistellung während der Kündigungsfrist) and had insightful discussions on this topic. What I found is that colleagues often worked for many years for the same employer. During this time, they didn’t think of marketing themselves on the labor market. This is a strategic error: never count/plan on your employer! Business has been changing for many years..

Often, people miss updating their profiles on professional platforms like LinkedIn, XING, etc. Why is that, as this is very easy to do?

When people move to outplacement companies, they suddenly realize they should have done something. It’s now hard to build self-confidence and learn to market yourself within weeks.

What could be the role of the employer? Wouldn’t it be more efficient if employees were trained and coached to market themselves during their work time?

During my consultant time reorganizing the Cash Management Department at the World Bank in 1994-1995, the World Bank had (and still has) efficient work programs for such events. In this respect, the World Bank in Washington DC is more of a Think Tank than a bank to me; it’s an employer with forward-looking programs and benefits for many.

Ziehen Sie Deutsch vor?

Kollegen arbeiteten oft viele, viele Jahre für denselben Arbeitgeber. Während dieser Zeit dachte er/sie nicht daran, sich auf dem Arbeitsmarkt zu vermarkten. Das ist ein strategischer Fehler – verlassen Sie sich nicht auf Ihren Arbeitgeber!

Oft scheuen sich Menschen auf Plattformen wie LinkedIn, XING zu zeigen. Warum?

Wenn Menschen zu Outplacement-Unternehmen wechseln, wird ihnen plötzlich klar, dass sie etwas hätten tun sollen. Jetzt und sofort Selbstvertrauen aufbauen und innerhalb weniger Wochen lernen, sich selbst zu vermarkten? Welche Rolle könnte der Arbeitgeber dabei spielen? Wäre es nicht effizienter, wenn die Mitarbeiter während ihrer Arbeitszeit darin geschult und gecoacht würden, sich selbst kontinuierlich zu vermarkten / netzwerken?

1994/1995 war ich als Berater für die Umstrukturierung von Cash Management bei der Weltbank tätig. Die Weltbank verfügt über effiziente Arbeitsprogramme für solche Fälle. Seit dieser Zeit ist die Weltbank in Washington DC für mich eher ein Think Tank als eine Bank. Ein Arbeitgeber mit zukunftsorientierter Aussicht.

Enjoy – The Tomato Team