TOMATO CATCH-UP - Newsletter Issue 281 - November 2025

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

With the year rapidly drawing to a close, many of you probably already work on a personal development plan for next year. For treasurers in particular, their function is no longer just cash flow and risk mitigation; it drives growth and enables innovation. While some traditional responsibilities are being redefined by automation, upskilling is becoming critical, especially in the area of AI. The The Association of Corporate Treasurers based in London has put together a comprehensive overview of the skills needed to excel in treasury, along with the types of people suited to this domain (and yes, being good with numbers is one of them).

This month's Catch-Up includes topics such as Stuctured Finance, Treasury Map, HSLU Treasury Study, Digital Trust Insights, Success & Wellbeing, Employment Trends, America Swan Song, The Genius Myth, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Nov 26.& 27.: Sehen wir uns? Structured Finance 2025 in Stuttgart

- Who is Who in Treasury: A Simple Map

- HSLU IFZ Finanzierungs-und Treasury-Studie 2025

- 2026 Global Digital Trust Insights Switzerland

- Intl. Transfers: Can companies like Wise, Airwallex, Revolut compete with global banks?

- Chancen für Erfolg und Wohlbefinden in verschiedenen Ländern

- EU Employment Trends 2024

- Book Tip – The Genius Myth: A Curious History of a Dangerous Idea

- Termine & Events

- From the Desk of Tomato

1. Nov 26.& 27.: Sehen wir uns? Structured Finance 2025 in Stuttgart

Kommende Woche Mittwoch und Donnerstag öffnet die Messe Structured Finance. Ich freue mich, Sie in Stuttgart wiederzusehen!

Möchten wir bereits vorab per Mail, LinkedIn oder Telefon einen Termin vereinbaren? So lässt sich der Tag gemeinsam planen – zwischen den Workshops oder frühmorgens bei einem sehr guten Kaffee am Unicredit Stand.

Suchen Sie mich auf dem Messegelände? Via der SF 2025 App oder ein Telefonanruf an meinen Kollegen Esra Kummer im Tomato Atelier Kloten - Zürich +41 44 814 2001. So treffen wir uns.

Für mehr Schweiz Orientierte findet am Donnerstagabend 27.11.2025 in Zürich der Future-Ready-CFO statt. Die Gastgeber sind BSgroup Data Analytics AG und die FS Partners AG.

2. Who is Who in Treasury: A Simple Map

Do you ever wonder who is active in the various segments of treasury? At Tomato, we often check this dynamic map for inspiration. Search criteria include over 15 categories (BSG, CFF, CMA, eBAM, ERP, ETL, FIDP, integrators, TRMS, PSP, and more) sub-categories, headquarter location, domain of activity, and keywords.

Source: Simply Treasury by François Masquelier. https://treasurymap.com/ (only companies that sponsor / pay the advertising fee are listed on the map).

3. HSLU IFZ Finanzierungs-und Treasury-Studie 2025

For the 5th time HSLU IFZ is offering Finance and Treasury study in German. With the following consent

- Liquiditätssituation

- Bankbedürfnisse von grossen Unternehmen

- Entwicklungen und Trends im Bereich Treasury-Technologien

- Working Capital Management

- Working Capital im internationalen Vergleich

- Die Kapitalstruktur kotierter Schweizer Unternehmen

- Finanzierung mit Eigenkapital

- Finanzierung mit Fremdkapital

- Nachhaltig Finanzieren – Grundlagen, Konzepte und Instrumente

Zusätzlich mit 6 sponsored Gastartikeln.

Details for your interest on this 200 pages PDF at HSLU (free download); see overview on page 4

4. 2026 Global Digital Trust Insights Switzerland

The way cyber leadership is adjusting to the new cyber environment is captured in PwC's 2026 Global Digital Trust Insights survey. It reflects the opinions of about 3,900 business and technology leaders from 72 countries, a wide range of industries, and sizes of organizations, including 62 from Switzerland. Nearly 25% of Swiss respondents work for companies that generate more than USD 10 billion in global revenue.

Main takeaways:

- 52% of Swiss firms are increasing cyber risk investments in response to geopolitical volatility

- 56% say technology modernisation is the top driver of cyber spend

- 1/3 of Swiss firms have implemented data controls across the entire data lifecycle

- Top 3 hurdles to implementing AI in cyber defence are unclear risk appetite, skills shortages, and knowledge gaps

- 11% of Swiss firms have implemented quantum readiness measures

- Half of Swiss executives engage with their CISO monthly, but only one in four involve them strongly in transformation initiatives.

Further reading on the PwC website (you need to provide your personal details for downloading the report)

5. Intl. Transfers: Can companies like Wise, Airwallex, Revolut compete with global banks?

Based on a report from DerTreasurer. For retail customers: Competition in global payments is increasing due to neobanks such as Revolut or Wise, which offer financial services (banking, international transfers, currency exchange and investments) via mobile apps.

For corporations: Companies such as Airwallex, Payoneer, Tipalti, and Wise offer services designed for businesses: multi-currency accounts, global payments, expense management cards, and integrations for large-scale payouts, especially for companies with international operations.

Tomato staff are curious and, based on the article from DerTreasurer, we have started to analyze the above-mentioned solutions. Mostly these suppliers above offer payments, transfer solutions for freelancers, interim staff, etc. Therefore, transfer amounts are mainly suggested in 4-digit amounts. We can’t find any solutions yet in range of EUR 100.000 or above. What is your experience integrating these neo solutions in Treasury?

Details in German Page 8 at DerTreasurer Magazin

6. Chancen für Erfolg und Wohlbefinden in verschiedenen Ländern

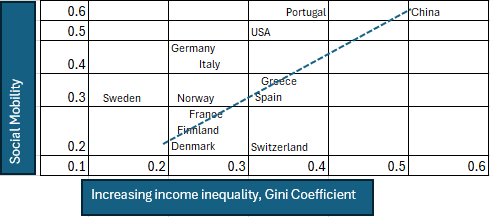

Alan B. Krueger, Berater von US-Präsident Obama, sprach von der «Great Gatsby»-Kurve: Je ungleicher die Einkommensverteilung, desto schwieriger ist es, die soziale Leiter zu erklimmen – und umgekehrt. Nach dieser Logik müsste die Schweiz mit ihrer vergleichsweisen geringen Ungleichheit auch durch eine hohe soziale Mobilität gekennzeichnet sein. Soziale Mobilität bedeutet, dass Erfolg unabhängig von der Herkunft der Eltern möglich ist.

In der Schweiz ist die soziale Herkunft für Wohlstand und Erfolg weniger entscheidend als in anderen Ländern. In den USA haben die Einkommensunterschiede in den letzten Jahrzehnten zugenommen, während das Bild in der Schweiz stabil bleibt.

Das duale Bildungssystem, ein flexibler Arbeitsmarkt und stabile Institutionen sorgen dafür, dass die Einkommen in der Schweiz gleichmässiger verteilt sind als in anderen OECD-Ländern

Source Tomato

Do you prefer English or French? Visit OECD site and scroll through the site to see details in your country.

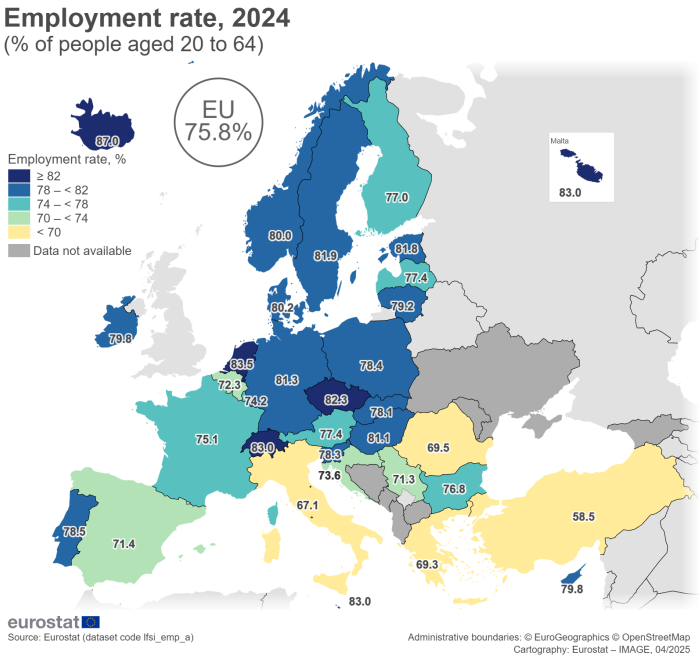

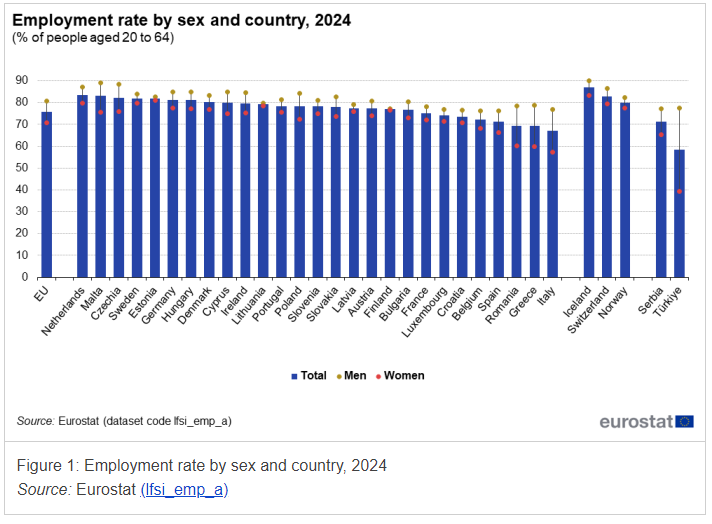

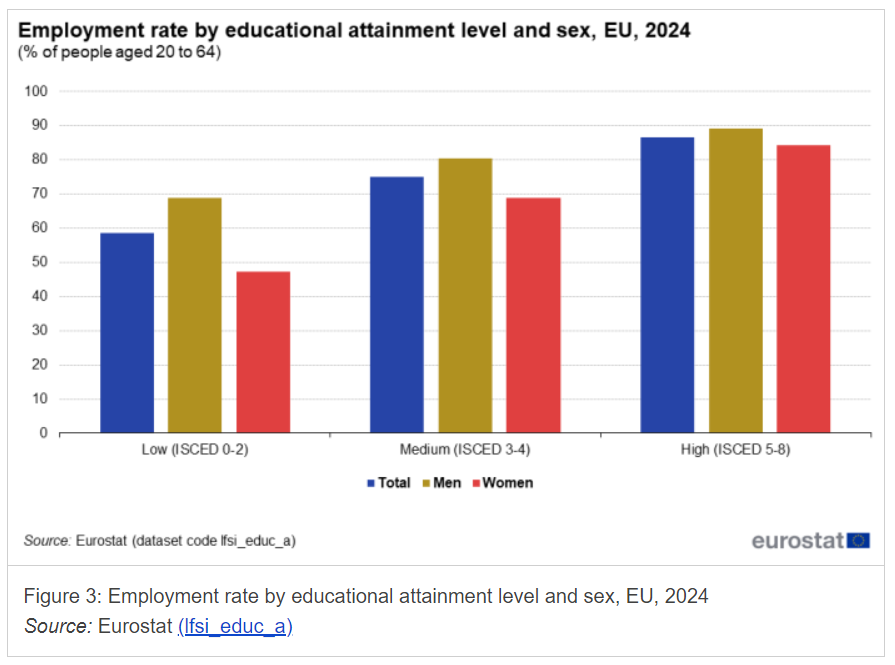

7. EU Employment Trends 2024

The most recent EU annual statistics on employment shows that the EU employment rate was 75.8% in 2024, ranging from 83.5% in the Netherlands to 67.1% in Italy.

Other key statistics:

- The EU employment rate for men stood at 80.8%, 70.8% for women; the gender employment gap was 10%.

- Across EU countries, 15 reported an employment rate exceeding 78%, 9 between 70% to 78%, and 3 below 70%.

- The widest gender employment gaps were in Greece (18.8%) and Italy (19.3%).

- Gender employment gap was relatively narrow in Baltic countries (~3%); in Finland the gap was almost negligible (0.7%).

- The employment rate for people aged 20-64 years who had attained a high level of education was 86.5%.

- The rate for those who had only completed a low level of education was 58.7%.

- Between 2015 and 2024, the employment rate for people with a low level of education increased by 7.8%.

- The employment gap between men and women widens as the level of educational attainment decreases.

- The highest proportions of employed people with high level of education in the EU were in Luxembourg (59.5%), Ireland (58.9%), Cyprus (53.1%), Lithuania (51.3%), Belgium (50.9%) and Sweden (50.8%). The lowest were found in Romania (23.5%), Italy (26.2%) and Czechia (27.7%).

More for Swiss interested readers details on Swiss employment statistics

8. Book Tip – The Genius Myth: A Curious History of a Dangerous Idea

This thought-provoking examination of the concept of genius comes from renowned Atlantic staff writer and broadcaster of the BBC program "The New Gurus," Helen Lewis. She argues that a society's values can be inferred from the people it considers geniuses. The author reveals how this one word has influenced and occasionally distorted our conceptions of accomplishment and success.

Lewis contends that the contemporary concept of genius has reached its limit. The author analyzes historical and contemporary Western ideas of genius while fusing in-depth research with her trademark humor and lightheartedness to paint a complex picture of human inventiveness. She questions whether most inventions are inevitable after discovering an army of neglected spouses or collaborators. She questions if the Beatles would still be successful today and tackles the perplexing conundrum of tech disruptor Elon Musk.

The Genius Myth modifies your conception of the "genius" and questions your presumptions about inventiveness, production, and creativity.

9. Termine & Events

- Nov 24-25, 2025: IACT 2025 Annual Treasury Management Conference, Dublin, Ireland

- Nov25, 2025: ACT Webinar : CFO and Treasury – Aligning for Strategic Impact, online webinar

- Nov 25-26, 2025: International Treasury & Cash Management, Sao Paulo, Brazil

- Nov 26 und 27: Structured Finance, Messe Stuttgart – Meet Martin Schneider!

- Nov 27, 2025: Tomorrow’s Treasury: The Crucial Conversations Conference, London, UK

- Dec 5, 2025: Swiss Treasurers ACT-SR: Perspectives Economiques 2026, Genève, Switzerland

- Jan 30, 2026: 2026 ACT Treasury Network Scotland Dinner, Edinburgh, UK

- Feb 16-17, 2026: FinTech Week: Payments, Security & Beyond, Dubai, UAE

- Mar 16-17, 2026: Agentic AI & Automation in Finance Summit, Atlanta, US

- Mar 17, 2026: ACT Cash Management Conference 2026, London, UK

- Mar 18, 2026: Future Identity Finance 2026, London, UK

- Mar 26, 2026: ACT Deals of the Year Awards 2025, London, UK

- Apr 14, 2026: EBINTEC Banking Innovation Conference and Exhibition, Istambul, Turkey

- Apr 16-17, 2026: EACT Summit 2026, Brussels, Belgium

- Apr 23, 2026: Agentic AI & Automation in Finance Summit, Frankfurt, Germany

- Apr 23, 2026: Treasury 360° Nordic 2026, Gothenburg, Sweden

- May 12, 2026: ENBANTEC Cyber Security Conference and Exhibition, Istambul, Turkey

- May 12-13, 2026: ACT Annual Conference 2026, Liverpool, UK

- Jun 11-13, 2026: CEE Treasury Forum 2026, Siofok, Hungary

10. From the Desk of Tomato

Lukas Bärfuss: Die Schweizer Mittelschicht und die Zukunft des Landes

Zehn Jahre nach seinem Essay „Die Schweiz ist des Wahnsinns“ (Tages-Anzeiger Abonnement required) gibt Lukas Bärfuss eine Bestandsaufnahme des Landes. 2015 sprach er unter anderem vom niedrigsten Wirtschaftswachstum aller OECD-Länder seit 1990 und von den demografischen Trends, die das Rentensystem zerstören.

Damals löste die übertriebene Abhandlung einen Sturm der Entrüstung aus. Letztendlich hat sich keine der Weltuntergangsprognosen von Bärfuss bewahrheitet, da die Schweiz in jeder Hinsicht gut abschneidet.

Dieses Mal analysiert Bärfuss die Gegenwart der Schweiz aus einer postkolonialen Perspektive. Vor zehn Jahren bewertete Bärfuss die Intervention der USA positiv und lobte ihre Rolle bei der Abschaffung des Schweizer Bankgeheimnisses. Heute glaubt Bärfuss, dass das Schicksal der Schweiz in Washington und an der NYSE entschieden wird.

Der Autor ruft zum Mittelschicht-Widerstand auf. Für ihn haben die obersten 1 % nichts zu befürchten und das unterste Drittel wird in Zukunft kein Mitspracherecht mehr haben.

Amrei-Marie, Lukas Bärfuss - Literaturfesteröffnung 2023, CC BY-SA 4.0

Enjoy the Tomato Team from the Tomato Atelier !