TOMATO CATCH-UP - Newsletter Issue 278 – July/August 2025

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

With summer already here, we face the uncomfortable reality that dressing well gets trickier as the temperatures rise. How do you ensure you stay cool and also elegant when going to the office in the summer? A Forbes contributor shares some tips:

- Breathability should be a priority: a relaxed cut not only keeps you cooler but also feels more in step with the season’s ease.

- Opt for fabrics that don’t retain heat: linen, seersucker, and tropical wool.

- Keep your accessories in neutral tones and lean toward browns rather than blacks, which create a softer contrast against lighter fabrics and bolder hues.

- Loafers are the go-to choice.

What else would you add?

This month's Catch-Up includes topics such as EBICS, AI in Treasury, Verification of Payee, Digitising Guarantees, Capital Markets, Corporate Taxes, IMF Review, Entropy Economics, and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Tomato at ACT-SR in Lausanne

- The Installation Day: Creating a SWIFT or/and EBICS Gateway

- Verification of Payee (VoP) with EBICS

- Wie man Garantien digitalisiert

- Capital Markets US vs EU

- Corporate Tax Rates Decline in Switzerland

- The IMF Washington Reviews Switzerland

- Book Tip - Entropy Economics: The Living Basis of Value and Production

- Termine & Events

- From the Desk of Tomato

1. Tomato at ACT-SR in Lausanne

Martin Schneider presented his views on how to use AI in Treasury. On June 18, 2025, Martin Schneider held for him a first-time presentation in French at the forum of ACTSR (Association of Swiss Treasurer Suisse Romandie) in Lausanne. Here are some of the topics Martin tackled in his presentation:

- AI in liquidity planning / cash forecast

- AI in energy price hedging, such as electricity and gas

- AI for data capture of manual processes

- Your AI Treasury project

You can find the full deck in French on Tomato’s English website: https://www.tomato.ch/AI.html (path is: tomato.ch and publications).

Unter „Fachbeiträge” auf tomato.ch finden Sie diesen Vortrag von Martin Schneider in deutscher Sprache mit einem kurzen Video und Interview. Der Vortrag wurde am ACTA TECH DAY am 7. November 2024 in Wien gehalten. Details finden Sie bei Tomato Catch-Up Nov-2024.

2. The Installation Day: Creating a SWIFT or/and EBICS Gateway

An EBICS gateway installation drastically reduces manual work, and it eliminates local manual work with e-banking. EBICS or SWIFT channels allow sending and downloading financial messaging, such as payments and bank statements for automatic reconciliation. We describe here the EBICS installation.

EBICS is a standard protocol that lets companies connect directly to a specific bank in Germany, Austria, France, and Switzerland. EBICS is an efficient connectivity option because it is highly standardized and ensures compatibility between different banks. Digital signatures and encryption are used to secure the data. EBICS uses standardized XML formats with common message types as well as SWIFT MTxxx messages.

When corporate staff are installing an EBICS connection to their bank on a specific day, patience and a fully concentrated mindset are required. Tomato often assists in the connection process to make sure everything runs smoothly. Four / six eyes principle.

Typical process to set up an EBICS connection:

- Registration: The company registers with each of its bank(s) to use an EBICS channel, which involves exchanging public crypto-keys and setting up user accounts.

- Authentication: Users are authenticated using secure methods such as password, PIN, or cryptographic token and provided with unique credentials.

Basis

- Secure communication: Shared data is encrypted, and each message is signed digitally to verify that it comes from a trusted source.

- Data processing: Transactions are initiated by the company's ERP or TMS and sent to the bank via the EBICS client. Once validated, the bank processes all the transactions via this channel.

- Automation: As with H2H, EBICS supports automated processes for initiating transactions and retrieving data, reducing manual work.

Further reading at Atlar (a Stockholm Consulting Company)

Ziehen Sie Deutsch vor? Die Schritte zum EBICS Kanal. Nehmen Sie sich einen ruhigen konzentrierten Tag vor. Am besten mit 4 oder 6 Augen.

- Softwarewahl: Stellen Sie sicher, dass Ihre Banking-Software EBICS unterstützt, und planen Sie die Umstellung mit allen Partnern (ERP, Softwarepartner, Bank interne IT)

- Bankkontakt: Informieren Sie Ihren Kundenbetreuer, um die EBICS-Vereinbarung zu erhalten.

- Zugangsdaten: Beschaffen Sie die EBICS-Zugangsdaten von Ihrer Bank, einschliesslich Benutzerkennung (Teilnehmer-ID), Berechtigung, KundenID und Hostname.

- Bankverbindung anlegen: Richten Sie die Bankverbindung in Ihrer Software ein und wählen Sie EBICS als Übermittlungsverfahren.

- Initialisierung: Starten Sie die Initialisierung der EBICS-Verbindung über Ihre Software, wobei Sie die Zugangsdaten eingeben und ggf. neue Sicherheitsschlüssel (Public/Private Keys) erstellen.

- Schlüsselübermittlung: Übermitteln Sie den öffentlichen Schlüssel (Public Key) an Ihre Bank, oft durch eine Initialisierungsdatei (INI). Unterschreiben Sie den INI Brief und senden Sie diesen an die Bank.

- Testübertragung: Führen Sie eine Testübertragung durch, um die korrekte Funktion der EBICS-Verbindung zu überprüfen.

Fragen - Für Weiteres kontaktieren Sie Martin Schneider oder +41 44 814 2001.

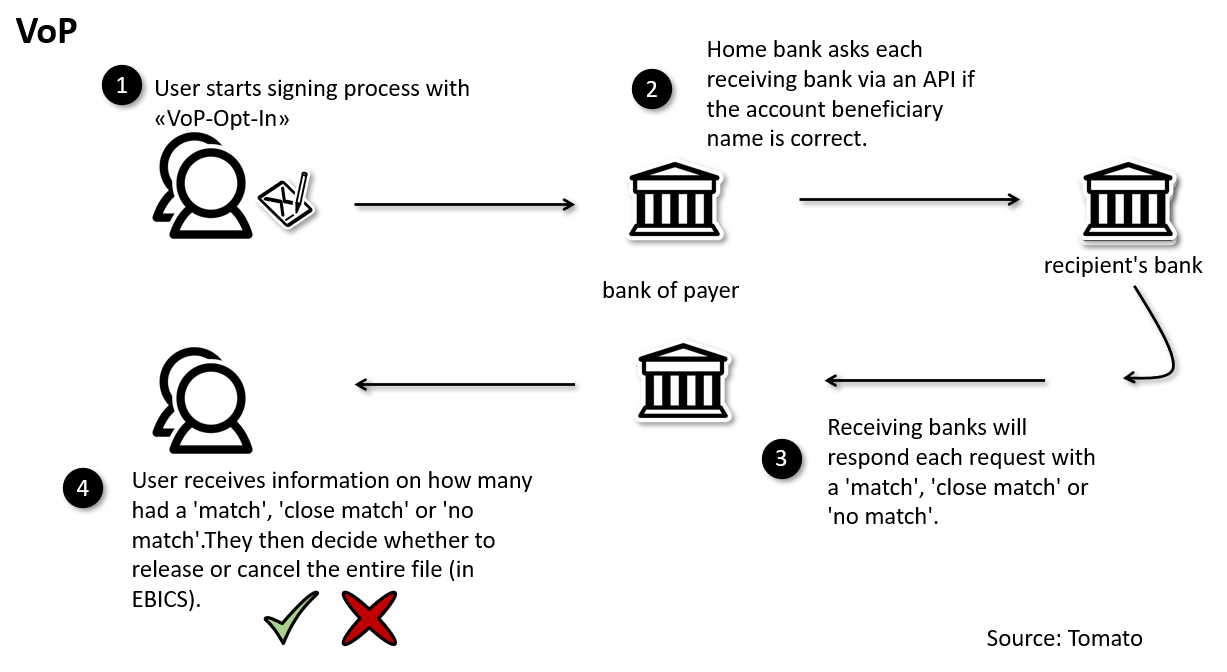

3. Verification of Payee (VoP) with EBICS

Verification of Payee (VoP) plans to be a new security measure for SEPA instant payments. This aims to lower payment errors and fraud. Regulation EU 2024/886.

Prior to the execution of an instant or a single payment, VoP entails comparing the payee's name to their IBAN starting on October 9, 2025.

When VoP is used with EBICS/SWIFT FileAct or H2H, new order types will be used. It is necessary to ensure that the software supports the new order types (opt-in to VoP) and the more complex approval process. This may vary depending on the software and the bank.

The new legislation might force VoP on single payments, even with an opt-out (no VoP with conventional order types). It's not carved in stone yet. If it goes into effect, workarounds include costly CCU transfers or splitting payments. For updates, stay in contact with Tomato and your bank.

Ziehen Sie Deutsch vor? Für File-ERP-Massenzahlungen sieht die die Instant-Payment-Regulierung vor, dass Firmenkunden freiwillig am VoP-Prozess teilnehmen können.

Opt-in: Mit dem sogenannten Opt-in kann der Kunde seine Daten prüfen lassen, während ein

Opt-out: den VoP-Prozess überspringt und die Zahlungen ohne Prüfungsauftrag versendet werden.

Neue Auftragsarten: Neben den bisherigen Auftragsarten CCT (für klassische SEPA-Überweisungen) und CIP (für Echtzeitüberweisungen) werden die Auftragsarten CTV und CIV neu eingeführt.

Details und Quelle Bank Vision oder auch PDF "Firmenkundeninfomation-Empfaengerueberpruefung_VOP" Punkt 2.1.4 bei ebics.de zu Aufträgen mit Einzelzahlung, 20 Seiten.

Tomato’s comment: we think using VoP for ERP mass supply payments may harm data privacy when the beneficiary bank is first asked if the client has the bank account in bank x (GDPR / DSVGO).

EPC-Video on VoP Verification Of Payee scheme for Instant Payments a 3 minute in English

4. Wie man Garantien digitalisiert

Prozesse in Bürgschaften Avalen Garantien sind der Digitalisierung weit entfernt: DerTreasurer berichtet in seiner Ausgabe, dass sich die Nachfrage nach Automatisierung erhöht und nennt zwei Fintech Firmen wie DVS Digital Vault Service in Passau und Trustlog in Hamburg (kurz Video 2Minuten)

An der Structured Finance 2023 lernte Martin Schneider das Unternehmen Mitigram kennen, das Lösungen für die Handelsfinanzierung anbietet. In enem 360T ähnlichen Prozessablauf von elektronischer Preisanfrage bis zur Abwicklung der Garantien mit Swift Nachrichten 7xx.

MitiSquare bietet Zugang zum universellen Marktnetzwerk, um Risiken, Kapazitäten und Preise von Partnerbanken in der globalen Handelsfinanzierung in Echtzeit zu bewerten. MitiManager bietet Transparenz über das gesamte Transaktionsportfolio und die Prozesse und unterstützt Corporates bei der automatischen Strukturierung aller Handelsfinanzierungsdaten.

Details zu Mitigram Lösung bei Tomato’s Kunden Brückner Group nähe Chiemsee Tomato Catch-Up Nov-2023

Details des obigen Berichtes im DerTreasurer scrollen Seite 6

5. Capital markets US vs EU

The article is based on Apostolos Thomadakis from the European Capital Markets Institute, Brussels.

A fundamental distinction between Europe and the US lies in the structure of their financial systems. The US is predominantly market-based, with a strong reliance on capital markets to fund businesses, while Europe is traditionally bank-based, where businesses rely more on loans from financial institutions than on equity or bond markets. Although the EU has made strides in spurring capital market development, banks still play a dominant role in corporate financing, particularly in smaller economies.

Instead of benchmarking itself against the US, the EU should focus on reducing intra-European barriers to capital flows. Harmonizing key areas such as taxation and insolvency law, while respecting Member States’ sovereignty and economic peculiarities, would create a more conducive environment for cross-border investment and allow for the development of deeper, more integrated capital markets.

Ziehen Sie Deutsch vor? Philipp Hildebrand früherer Präsident Schweizer Nationalbank 2010-2012, beschreibt in einem NZZ-Interview: Europa muss einen integrierten, liquiden Kapitalmarkt aufbauen. Ein besser funktionierender Kapitalmarkt hilft, Innovation zu finanzieren und Unternehmen schneller wachsen zu lassen. Der Euro braucht aber auch ein gemeinsames, sicheres Finanzinstrument – vergleichbar mit den US-Treasuries.

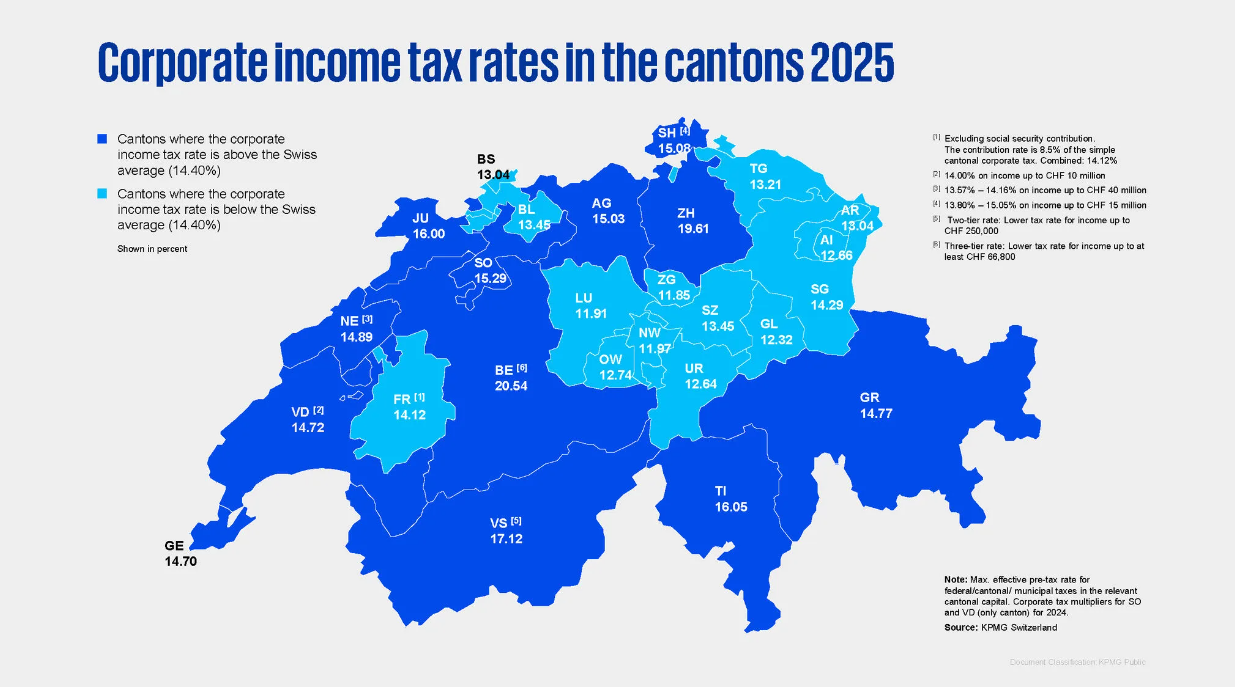

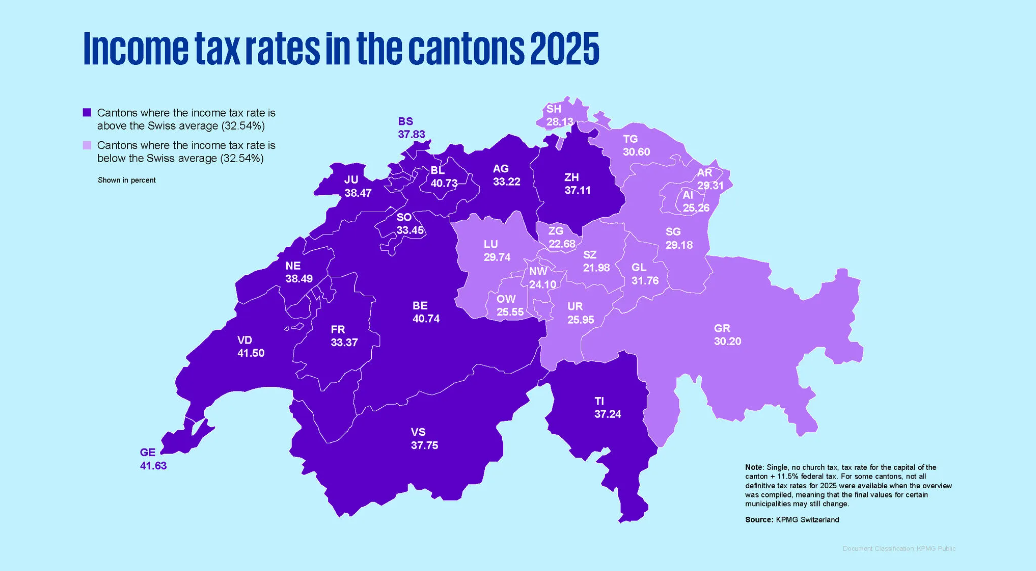

6. Corporate Tax Rates Decline in Switzerland

According to KPMG’s Swiss Tax Report 2025, the corporate tax rates for companies in Switzerland fell from 14.6 to 14.4% year over year. This report compares corporate and income tax rates from more than 50 countries and all 26 Swiss cantons. Other key findings:

- Tax rates for high-income private individuals in Switzerland fell from 32.7 to 32.5% compared to 2024.

- 10% of all taxpayers pay nearly 80% of direct federal taxes;

- ~40% of tax revenue is paid by 1% of the highest earners;

- Nearly two-thirds of the cantons have reduced their tax rates, with the largest cuts coming from Geneva (-1.70%) and Schwyz (-0.61%);

- Many other countries have been working to implement the global minimum tax rate of 15% (the corresponding rules have already entered into effect in around 50 countries to date);

- In Europe, only Guernsey (0.0%), Hungary (9.0%), and Bulgaria (10.0%) still offer lower corporate tax rates than Switzerland;

- Ireland (12.5%) remains the country’s most important competitor in Europe;

- The Bahamas (0.0%), the Cayman Islands (0.0%), and Bahrain (0.0%) stand out as low-tax domiciles.

7. The IMF Washington review in Switzerland

Every five years, major world financial centers receive a review on financial market stability: a country assessment by the IMF (International Monetary Fund). The most recent IMF country assessment of Switzerland was, of course, influenced by Credit Suisse 2023. The findings and suggestions:

- IMF seems to agree to underly TBFT-banks with higher capital (TBFT = too big to fail);

- The FINMA categorizes banks in several pillars (FINMA = Swiss Financial Market Supervisory Authority)

- category 1 as UBS

- category 2 as Raiffeisen-Gruppe, Zürich Kantonalbank, PostFinance

- category 3 total 27 Banken (link to FINMA bank categories)

A detailed IMF report on Switzerland is expected this fall. In addition to financial market regulation, the IMF auditors also assessed the country's monetary and fiscal policy. The latest interest rate cut by the National Bank from 0.25 to 0 percent is considered “appropriate” by the auditors. The experts described the Swiss franc as currently valued fairly.

Details in English at IMF.org und in Deutsch bei NZZ

8. Book Tip - Entropy Economics: The Living Basis of Value and Production

According to conventional economics, perfect competition makes markets ideal. An ordered economy is one in which supply and demand are balanced. In their work, James K. Galbraith and Jing Chen demonstrate how such notions run counter to the fundamentals of our scientific knowledge of the biological and physical realms.

Their book offers a fresh perspective on economic issues that is based on life processes – an uneven, constantly changing world where rules, plans, and boundaries are crucial. Scarcity is the foundation of Galbraith and Chen's theory of value, and it accounts for the power of monopoly. Their theory of production addresses the effects of rising resource costs, uncertainty, fixed investments over time, and increasing and declining returns. Entropy Economics is a framework for understanding the economic challenges of a world threatened with disorder.

Link to the book on the University of Chicago Press

9. Termine & Events

Weiterbildung / Kurse:

- Aug. 17-23, 2025: VDT Treasury Sommerkurs, Frankfurt, Germany

- Jan. - Sept. 2026 Lehrgang CAS Swiss Certified Treasurer / Intro 2-Minuten HSLU

Seminare

- Aug. 26, 2025: PwC Treasury Tech Days, Zurich, Switzerland

- Aug. 28, 2025: PwC Treasury Tech Days, Geneva, Switzerland

- Sept. 3, 2025: PwC Die Schweizer MWST-Tagung, Bern, Switzerland

- Sept. 2, 2025: Treasurers.org ACT Treasury Network London member event, London, UK

- Sept. 12, 2025: Baltic Treasury Conference, Vilnius, Lithuania

- Sept. 17, 2025 HSLU Swiss Treasury Summit in Rotkreuz, Luzern mit Teilnahme Martin Schneider

- Sept. 15-16, 2025: Money Live North America,

- Sept. 16-18, 2025: Advancing Payment Security Through Global Collaboration, Fort Worth, TX, USA

- Sept. 18-19, 2025: New York Cash Exchange 2025, New York, USA

- Sept. 22, 2025: Fachtagung zur Geldwäschereigesetzgebung 2025, Zurich, Switzerland

- Sept. 29 – Oct. 2, 2025: Sibos Frankfurt, Frankfurt, Germany

- Oct. 15-17, 2025: 34th annual EuroFinance International Treasury Management, Budapest, Hungary

- Oct. 22, 2025: Cash Pooling für Schweizer Konzerne in Zürich von SLG Wien

- Oct. 26-29, 2025: Money 20/20 USA, Las Vegas, USA

- Nov. 4-5, 2025: Fraud Leaders Summit, Cannes, France

- Nov. 12, 2025: Treasurers.org ACT Annual Dinner, London, UK

- Nov. 26 und 27: Structured Finance, Messe Stuttgart

- Nov. 13, 2025: Swiss Treasurers ACT-SR: BNS “Monetary Market” Conference, Geneve, Switzerland

- Nov. 19-20, 2025: Money Live Payments Europe, Amsterdam, The Netherlands

- Nov. 24-25, 2025: IACT 2025 Annual Treasury Management Conference, Dublin, Ireland

- Nov. 25-26, 2025: International Treasury & Cash Management, Sao Paulo, Brazil

- Dec. 5, 2025: Swiss Treasurers ACT-SR: Perspectives Economiques 2026, Genève, Switzerland

10. From the Desk of Tomato

Kennen Sie Grübeln? Man verbringt Zeit sich zu hinterfragen was geschehen könnte. Ich fand das Drei-Gang-Training von Judson Brewers löst mich von Grübeln. (Judson Brewers, Psychologe und Neurowissenschaftler)

Erster Gang: Gewohnheiten erkennen

Bevor Sie losfahren, prüfen Sie das Terrain. Beim Grübeln heisst das: Beobachten Sie, wann es beginnt. «Das Kartieren der Gewohnheit». Dieses bewusste Wahrnehmen ist wie das Einstellen des Sattels – die Grundlage, um ins Rollen zu kommen.

Zweiter Gang: Die Belohnung hinterfragen

Schalten Sie in den zweiten Gang und prüfen Sie, ob das Grübeln wirklich hilft. Fragen Sie sich: Was bringt mir das Sorgenmachen? Wenn klar wird, dass Grübeln keine Probleme löst, verliert es seinen Reiz.

Dritter Gang: Neugier als Antrieb nutzen

Im dritten Gang bieten Sie Ihrem Gehirn eine bessere Alternative. Statt sich in Sorgen zu verlieren, werden Sie neugierig auf Ihre Körperempfindungen. Wie fühlt sich Angst gerade an? Neugier statt Grübeln wird allmählich zur neuen Gewohnheit.

Evelyn Binsack bekannt als Extrem-Sportlerin in Bergsteigen, Bergführerin und als Referentin drückt sich so aus: Wer gelernt hat, Griff für Griff die Angst zu besiegen, findet auch im Alltag Halt, wo andere keinen Halt sehen.»

Das Proverb von Eleanore Roosevelt hat Sinn: “Do one thing every day that scares you”.

Überwinde die Angst !

Enjoy Martin and Team from the Tomato Finance+IT Atelier