TOMATO CATCH-UP - Newsletter Issue 258 – June 2023

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

With summer vacation approaching, we might be prone to overlooking some important topics like the economy outlook, especially at a time when things are progressing so rapidly. To stay up to date with noteworthy topics, you can keep your eye on Deloitte’s Weekly global economic update, in which Deloitte’s team of economists examines news and trends from around the world.

This month’s Catch-Up includes topics such as SAP-BCM-MBC, Cash Management, Transfer Pricing, Sustainability & ESG, Value Leakage & IT Outsourcing, AI and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- Zahlungsverkehr via SAP-BCM-MBC - wie geht das?

- Wird Cash Management unterschätzt?

- Report Shows the Paradox Behind Sustainability Commitment

- Transfer Pricing: 5 Tips

- New Framework for Corporate Investments in Natural Capital

- Value Leakage in the Context of IT Sourcing

- The Jobs AI Won’t Take Yet

- Book Tip – Rule of the Robots: How Artificial Intelligence Will Transform Everything

- Termine & Events

- From the Desk of Tomato

1. Zahlungsverkehr via SAP-BCM-MBC - wie geht das?

Diese Lösung ist interessant für alle, die den ZV konzernweit mit SAP-Modulen abwickeln wollen. Weiterhin geht es um zentrale Visibilität und lokale Verantwortung.

Unsere vielfach präsentierte 8-seitige PDF haben wir mit dem SAP-Modul MBC Multi-Bank-Connector erneuert. Es bietet eine verbesserte integrierte Wahl der Bankkanäle SWIFT, EBICS oder H2H (H2H = manuelle Verbindung).

Alternativ zum SAP-MBC kann man es, wie bisher, mit dem SAP-BCM (zentrales e-banking Freigabe-tool), mittels sFTP mit einem Swift Service Büro verbinden.

Integrierter und bequemer ist, die Zahlungsfiles aus dem SAP-FI (Lieferanten) dem Freigabetool BCM an BCM zu übertragen. Im MBC wählen Sie, welchen Kanal Sie zu einer Partnerbank nutzen (Swift oder Ebics). Die vorab zentral evaluierten und gewählten wenigen Partner-Bank(en) sind mittels Pflichtenheften zu bestimmen (Slide 8).

Der Buchstabendreher BCM / MBC ist eventuell von SAP gewollt.

Für non-SAP Module zeigen wir unter Option 3 (Seite 7) die non-SAP Cockpit Lösung mit einem non-SAP-TMS.

Do you prefer English?

We have just updated the option 1- slide 5 with SAP BCM MBC. In the previous version, the connection was made via sFTP to the Swift Service Bureau. Now the SAP-MBC module takes over this work/connection to the before evaluated, chosen, and reduced few partner-bank(s).

View slide in detail at Tomato’s Fachbeiträge

Those who have installed and use MBC we would appreciate your feedback to martin.schneider@tomato.ch

2. Wird Cash Management unterschätzt?

Bericht von DerTreasurer: In Zeiten, in denen die Zinsen steigen und Geld wieder an Wert gewinnt, ist Cash Management wieder mehr im Fokus. Auf der Handelsblatt Jahrestagung Restrukturierung 2023 in Frankfurt wurde unter anderem diskutiert, dass das Treasury das Cash Management nicht gründlich genug beherrscht.

Textlich gekürzt von Tomato: Sven Guckelberger, LBBW, Michael Keppel, Alix Partners, Johannes Steinel, Partner bei Eight Advisory halten fest, dass so einige Treasurer noch etwas in der Vergangenheit ohne Liquiditäts- und Cashflow-Planung leben, dass Schulungsbedarf besteht bzw. bewirtschaften besser als verwalten ist.

Kommentar Martin Schneider: Wir denken, Treasurer wollen und sind aktiv in ihrer Berufung, die Liquidität ihrer Unternehmen zu bewirtschaften.

Allerdings kann es Handycaps geben, wie:

- Genügend Betriebsmargen, dass von Finanzmitarbeitern die Notwendigkeit von guten Tools oder Prozesse zu optimieren von der Geschäftsführung nicht (ein)gesehen wird. Das Resultat: Mitarbeiter churning, keine Finanz-Transaktion-Skalierbarkeit bei Firmenwachstum.

- Einige CFO’s bevorzugen (statt integrierter Prozesse) schnelle, einfache Verbesserungen wie z.B. Finanzierungen, FX, Bankgebühren verhandeln und andere einfach zu erzielende Resultate.

- Die Zusammenarbeit zwischen Treasury und IT (Umsetzung der Prozesse) ist von Langatmigkeit belastet und IT Fachpersonal, dass sich für andere Abteilungen wie Finanzen interessiert.

Aus solchen und ähnlich weiteren Gründen kann es von aussen so erscheinen, dass Cash Management und deren verbundenen integrierte Prozesse nicht funktionieren oder Trainingsbedarf besteht.

Details in DerTreasurer Nr. 10 vom 17 Mai 2023

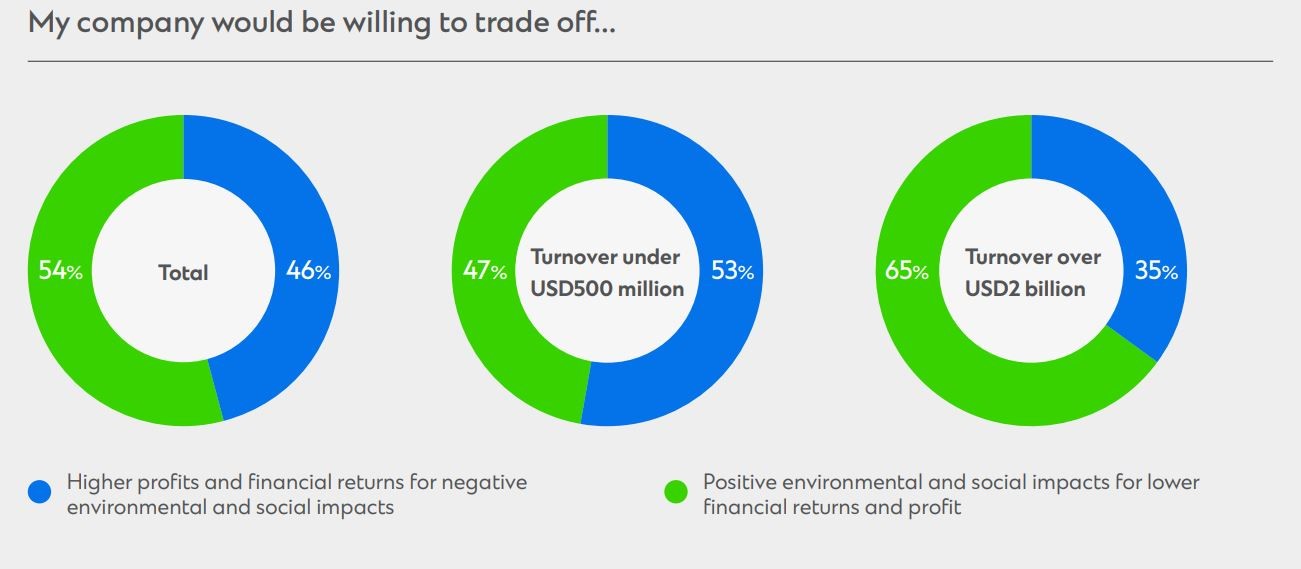

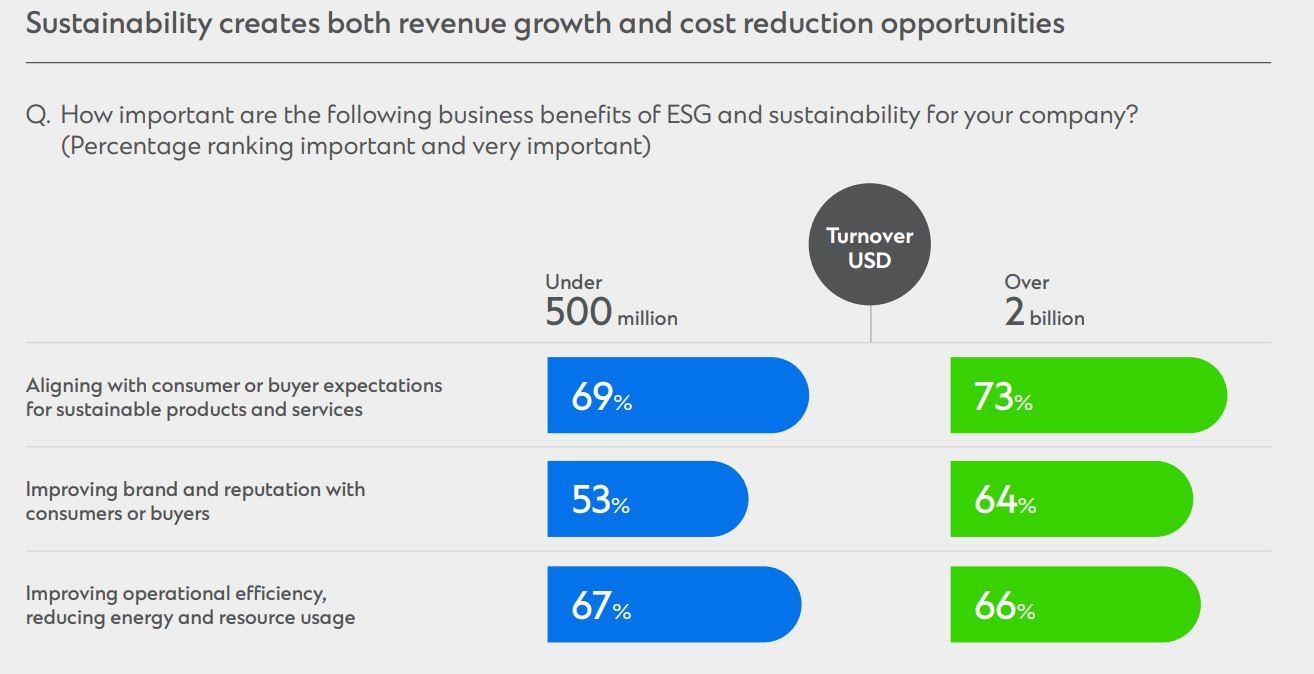

3. Report Shows the Paradox Behind Sustainability Commitment

A study by Standard Chartered Bank sheds light on barriers to greater sustainability commitments and provides insights into sustainability perceptions, practices, and beliefs within organizations. The findings are based on a survey of 300 mid- and large-sized companies worldwide, with revenues of more than USD500 million and less than USD 2 billion. This size corresponds with the typical Tomato clientele.

Key findings from the 300 asked SMEs:

- Over 60% are creating more sustainable products and changing how they distribute them;

- 54% would be willing to trade off positive environmental and social impacts for lower financial returns;

- 46% prioritized trading off higher profits and financial returns for negative environmental impacts;

- Over 50% are reducing resource consumption and emissions;

- Less than 30% have made sustainability commitments or set targets;

- 50% find it challenging to work with suppliers to improve their ESG practices;

- Nearly 80% are either already taking, or plan to take advantage of sustainability opportunities;

- Less than 25% of the companies with turnover under USD500 million are willing to commit or set a target to reduce air and water pollution or to use renewable energy sources;

- 50% or more face challenges in understanding shifts in the attitudes of their customers, determining the most efficient distribution routes, and building in-house ESG expertise.

Check all the findings in the Standard-Chartered-Report.

4. Transfer Pricing: 5 Tips

David McDonald from PwC writes in TMI (Treasury Management International) about 5 things that help you stay active and up to date on transfer pricing:

- Statement: Group Tax is responsible for transfer pricing. Treasury sets and applies the policies.

Risk: Without clear communication between the treasury and tax departments, there is a risk of penalties. - Statement: We have a great policy established and 2017 by a specialist and run it this way.

Risk: In 2020, the OECD published detailed guidelines focused on IC-loans, cash pool, guarantees, hedging, and captive insurance. We stayed tuned and made the necessary updates. - Statement: We have benchmarks; we use fixed rates from 2020.

Risk: Prices have changed significantly in the last 12 months. The use of outdated benchmarks is dangerous. - Statement: The excellent bank relationship ensures indicative quotes for IC-transactions.

Risk: OECD guidance state clearly that bank quotes are not an acceptable form because tax authority can/will ignore them. Use a transfer pricing benchmark that can be defended. - Statement: Performing detailed analyses on every loan and related party.

Risk: IC-Loan amount/size matters for tax at risk. A 5m IC-loan is less at risk than a 50m IC-loan. Use a standard policy that applies to 80-90% of intra-group loans and only evaluate the largest transactions.

Read more details in the PwC report on TMI (Login required, report available at Tomato).

5. New Framework for Corporate Investments in Natural Capital

As the planet's natural capital is declining, a Reuters’ report shows that funding for ecosystem protection is paramount.

In this respect, the Corporate Sustainability Reporting Directive (CSRD), approved by the European Council in November 2022, establishes the framework for corporate investments in natural capital to be shown as an asset on balance statements. The directive encourages businesses to include investments in nature regeneration and conservation in their operating and capital expenditures.

Why might this change everything? Corporate risk assessments now must take sustainability information into consideration. Investments must meet the accounting requirements of International Financial Reporting Rules - IFRS before natural capital funding can be shown on business balance sheets: identifiability, controllability, cost measurement accuracy, and likely future economic advantages.

This capitalization of natural capital funding could unleash numerous investments into nature while investments in natural capital may soon factor into how insurers and equity providers assess corporate risk.

Read more on Reuters.

6. Value Leakage in the Context of IT Sourcing

Another point of the myth of Lift and Shift (May NL and tomato article) is written in the article by Miles Underwood and Lutz Gerhards of KPMG.

In the context of IT sourcing, value leakage refers to the discrepancy between a business case's actual results and its initial projections (often expressed as a baselined business case). It can also mean missed opportunities to deliver benefits, which may not have been identified in the original business case.

The authors point out the fact that value leakage can occur at all stages of a sourcing process:

Pre-Contract Leakage

The typical areas where this problem occurs are in the SLA, contracting for modern cloud services or in the articulation of scope. While traditional SLAs may be renegotiated, standard cloud services agreements adjustment prior to the renewal period is hard to address. The strategy of relying solely on the due diligence carried out by incoming suppliers to identify scope can lead to issues later in the relationship.

Post-Contract Leakage

These are often linked to the failure to implement the service (including transition), sub-optimal performance monitoring, or ineffective governance. In the implementation process, the main cause behind value leakage is delay. In performance monitoring, value leakage appears in the form of services that have been paid for but not delivered. Rigor around the charging process, from initial quotations and purchase orders through to invoice payments, is usually sub-optimal, results in incorrect charging for services.

The Solution: investment in value leakage prevention capabilities.

7. The Jobs AI Won’t Take Yet

The BBC article “The Jobs AI Won’t Take Yet” lists jobs that computers won’t take for some time despite claims that AI will replace workers.

There have been concerns that new machines will take human jobs ever since the beginning of the industrial revolution, yet people have always triumphed. However, some jobs are now being seriously threatened by robots. According to a recent Goldman Sachs research, content-generating AI might perform one-fourth of the job currently performed by humans. In addition, automation might cost the EU and US 300 million jobs.

However, Martin Ford, author of Rule of the Robots: How Artificial Intelligence Will Transform Everything (see our Book Tip), believes that there are three “safe zones”:

- Genuinely creative jobs, where coming up with new ideas and building something new is important;

- Jobs that require sophisticated interpersonal relationships, like nurses, business consultants, and investigative journalists;

- Jobs that require lots of mobility, dexterity, and problem-solving abilities in unpredictable environments, like electricians, plumbers, or welders.

The safe approach for everyone right now? Think what kind of tasks within your job will be replaced or will be better done by computer or AI; and what is your complementary skill? Also important to note, an advanced education or a well-paying job do not protect against AI takeover. Ford illustrates that the future of the white-collar worker is more threatened than that of the Uber driver, because we don't have self-driving cars yet, but AI can certainly write reports.

Further reading on BBC or the full report from Goldman Sachs (20 pages)

8. Book Tip – Rule of the Robots: How Artificial Intelligence Will Transform Everything

Martin Ford, who is an expert on artificial intelligence and robotics and their potential impact on the job market, economy and society, gives us a compelling glimpse into the very near future, claiming that AI is a particularly potent technology that is changing every aspect of human life, frequently for the better. For instance, robots are solving complex scientific problems in molecular biology that people were unable to, and AI can aid in the fight against climate change or the next epidemic. It also has the potential to cause great harm. Deep fakes, or AI-generated audio or video of unreal occurrences, have the potential to devastate society. AI gives authoritarian governments like China access to previously unheard-of social control tools. And AI has the potential to be extremely prejudiced, picking up on our racist attitudes and then repeating them.

AI is not a technology that should be blindly adopted or left to others' concerns. If we want to survive in the twenty-first century, each of us needs to understand that the machines are coming, and they won't stop. The definitive manual for all of it, including AI and the direction our economy, politics, and way of life will take, is Rule of the Robots.

9. Termine & Events

- Jun. 15, 2022 General Assembly ACTA Wien Austrian Treasury Association

- Jun. 19 – 21, 2023: Coupa Inspire EMEA 2023 in London

- Jun. 19 – 23, 2023: Fintech Week London, UK

- Jun. 20, 2023: DerTreasurer: Cash Management Campus in Köln Germany

- Jun. 20 – 21, 2023: Payment Leaders’ Summit, Washington, USA

- Jun. 20 – 22, 2023: TMI: SAP for Treasury and Working Capital Management Conference EMEA, Amsterdam, The Netherlands

- Jun. 22, 2023: ACT Treasury Network Scotland: Drinks and networking event, Glasgow, UK

- Jun. 22, 2023: Banking Transformation Summit, London, UK

- Jun. 22 – 23, 2023: World Finance Forum Amsterdam, The Netherlands

- Jun. 26 – 28, 2023: Central Bank Payments Conference, Cape Town, South Africa

- Jun. 27, 2023: Cash Forecasting 2.0: The Emergence of Liquidity Planning, webinar by TMI

- Aug. 14 – 15, 2023: Vencent Fintech Summit, Bridging the future of banking and fintech, Little Rock Arkansas, USA

- Sep. 8 – 21, 2023: SIBOS: Collaborative Finance in a Fragmented World, Toronto, Canada

- Sep. 11 – 13, 2023: Finnovate Fall: The world’s premier fintech showcase, New York

- Sep. 13, 2023: Swiss Treasury Summit Jahrestreffen Schweizer Treasurer, Rotkreuz (Zug/Luzern)

- Sep. 25 – 29, 2023: in Wien Austria; SLG Seminar 5-Tage Lehrgang Aufbau einer modernen Treasury-Abteilung

- Sep. 27 – 29, 2023: EuroFinance International Treasury Management, the world’s largest treasury event, Barcelona

- Oct. 10 – 11, 2023: Payment Leaders’ Summit, London, UK

- Oct. 18 – 19, 2023: Structured Finance in Stuttgart Kongress für Unternehmensfinanzierung und Treasury

- Oct. 24 – 25, 2023: ACT Middle East Treasury Summit 2023 by the Association of Corporate Treasurers, Dubai, UAE

10. From the Desk of Tomato

Eine Hommage an den Wirtschaftswissenschaftler, der den Menschen rationales Verhalten zutraute

Der Wirtschaftswissenschaftler und Nobelpreisträger Robert Emerson Lucas Jr. ist am 15. Mai 2023 im Alter von 85 Jahren gestorben. 1995 erhielt er für die Entwicklung und Anwendung der Hypothese der „rationalen Erwartungen“ den Nobelpreis für Wirtschaft.

Lucas gilt weithin als Schlüsselfigur bei der Ablösung des Keynesianismus, wonach die Wirtschaft eine Maschine ist, die nur an den richtigen Schrauben gedreht werden muss, um das gewünschte Ergebnis zu erzielen.

In den Wirtschaftswissenschaften waren die Erwartungen ein Nebenschauplatz; hier kommt Robert E. Lucas ins Spiel. Der Nobelpreisträger vertrat die Theorie, dass die wirtschaftlichen Fakten die Summe der menschlichen Entscheidungen sind, im Gegensatz zur herkömmlichen Auffassung, wonach sich die Erwartungen für die Zukunft aus der Vergangenheit ergeben.

Lucas vertraute den Wirtschaftsakteuren mehr. Obwohl er die Theorie der rationalen Erwartungen nicht selbst entwickelt hat, war er dafür verantwortlich, dass sie zum Standard in der Makroökonomie wurde. Die Modelle wurden in der Folge komplexer und nahmen die Menschen endlich als rationale Wesen ernst, die differenzierte Entscheidungen treffen. Die neuen Modelle zeigten, dass die Menschen nicht so leicht von der Regierung getäuscht werden können.

Die Wirtschaftspolitik hat in der Regel keine dauerhaften Auswirkungen ausser einem Anstieg der Preise, da die Menschen in der Lage sind, die Zusammenhänge zu erkennen und ihr Verhalten zu ändern.

Details in der NZZ in Deutsch

Do you prefer English?

Robert Lucas Jr., a contrarian Nobel laureate in economics, died at 85. Professor Lucas was best known for his hypothesis of “rational expectations”. He maintained that consumers and businesses make their decisions on the basis of rational expectations drawn from their own past experiences.

Details in the New York Times

You may watch the 15 minute YouTube video and perhaps pause it from time to time to study detailed PowerPoint drawings.

Photo from the Nobel Foundation archive 1995