Tomato Newsletter No. 237 - June 2021

Your monthly resource on working capital, process optimization, and issues related to the world of corporate treasurers, IT professionals, and bankers!

This newsletter is bilingual, English or German, depending on the source.

Introduction

When it comes to the home office, some people like it, while some people would prefer to return to their offices as soon as possible. For some companies, home office meant a new setup in the pandemic while for others it brought nothing new, they were very well accustomed to this.

What are the pros and cons? For example Novartis has 90.000 worldwide and 10.000 Swiss employees at home office. The employees have access to the web portal, Tignum X and are consulted by a professional HR-department, with resilience, health and movement, and there are many other features for their staff. See also our book tip point 8 on how to build trust & connection in the hybrid world.

A con? Some employers are tracking productivity (link to Handelszeitung) by digital monitors. Do you believe that this a major issue that needs to be dealt with or that most employees are not concerned and happy with their setup? We’d love to hear your opinion!

This month’s Catch-Up includes topics such as SWIFT Assessment, Outsourcing, Central Bank Money Supply, Inflation and more.

Remember that for any challenge related to your financial issues, you can ask Martin Schneider for a discussion that will clarify it. Contact Martin via email or call +41 44 814 2001.

- For Corporate the New Swift Assessment

- Vermeiden von Fehlern beim Outsourcing

- Schuldschein: Helping SITA Rebuild the Airline Sector

- Central Banks Balance Sheet Growth and Inflation

- Inflation: Does It Stay or Does It Disappear?

- Treasury Functions in Banking – the Driving Force Post-Covid

- Wo lebt man in der Schweiz am günstigsten

- Book Tip – Digital Body: How to Build Trust & Connection, No Matter the Distance

- Termine & Events

- From the Desk of Tomato

1. For Corporate the New Swift Assessment

All SWIFT users have to demonstrate their level of compliance with a set of mandatory controls as described in the Customer Security Controls Framework (CSCF):

Users opting for an external assessor must ensure that:

- The selected assessor has existing cybersecurity assessment experience to an industry standard such as PCI DSS;

- The lead assessor holds at least one industry-relevant professional certification, e.g. CISA; Other individual assessors should also have relevant security industry certification(s);

- When an internal department is used to execute a Community-Standard Assessment, users are advised to take steps to ensure that those involved in the assessment execute their duties in an objective fashion, free from undue influence (including but not limited to independent reporting lines between assessors and controls owners).

Users opting for an internal assessment must ensure that:

- The assessment team is independent of the 1st line of defense (CISO): eligible teams are typically Internal Audit (3d line of defense), Risk Office (2nd line of defense), or a tailored independent team established for the assessment;

- The selected assessor has existing cybersecurity assessment experience to an industry standard such as PCI DSS;

- The lead assessor holds at least one industry-relevant professional certification, e.g. CISA. Other individuals assessors should also have relevant security industry certification(s).

More details on the Swift website

Conclusion by Martin Schneider:

It took me a while (several weeks) to realize the benefits and importance of such an assessment. The more I look back on my customer experience, the more I agree.

- With basic e-banking, the security and access risk and control are completely in the hands of the company and their internal audit. Bank authorized users are designated company employees registered separately with each bank;

- When using bank gateways such as SWIFT and/or EBICS with a corporate seal or perhaps via VEU*, all payments are executed through these two gateways;

- The payment files originate in the accounting system (the ERP) or individual payments in the TMS (usually external cloud provider) and are then transferred to and processed by the bank(s). Payments are therefore cross-software, cross-company.

Corporate users and corporate treasury ensure basic compliance on how to trade, protect, and secure the transactions. It is important to verify such cross-company processes from the ERP to each of the connected banks. For Group Internal Audit, such as end-to-end compliance process makes a lot of sense. It provides security and identifies potential leaks that need to be addressed.

In each production process, each company is licensed and goes through some internationally recognized (ISO) certification tests. Payments and treasury rules are often a bit "old-school" with permission. Newly, certifications are also required in treasury.

Not only for SWIFT, but also for EBICS, I propose a certificate. Under the supervision of internal audit, for security reasons we should all value to these processes more. As for local e-banking, there should be a central guideline and an audit questionnaire.

Contact Martin Schneider via email or call +41 44 814 2001.

*VEU = Verteilte elektronische Unterschrift: One or two corporate employees sign/deliver each payment file over the gateway

2. Vermeiden von Fehlern beim Outsourcing

Der Trend zum Outsourcing in all seinen Facetten ist in vielen Unternehmen kaum mehr wegzudenken. Obwohl sehr viele Erfahrungen gemacht werden, wiederholen sich in gleichem Masse die Fehler. Zum Teil werden zu hohe Erwartungen an die Dienstleister gestellt, die in einem sehr kompetitiven Umfeld auch keine Wunder vollbringen können. Zum anderen wird oft unterschätzt, was der eigene Beitrag zu einem erfolgreichen Outsourcing ist.

Sacha Hofer, unabhängiger Dozent, HSLU empfiehlt in der Netzwoche ein Management of Chance.

Das MOC umfasst folgende Kernfragen

- Wie wird meine Organisation auf die Veränderungen reagieren, und wie muss kommuniziert werden?

- Welche direkten und indirekten personellen Konsequenzen wird das Outsourcing haben?

- Wie sieht mein "Governance"-Modell und das Change-Management aus? Wer entscheidet? Wer finanziert?

- Welche Prozesse sind betroffen? Sind alle dokumentiert?

- Welche KPIs (Messkriterien) sind definiert? Wie messe ich ein erfolgreiches Outsourcing?

- Wie lange dauert die Transformation? Was passiert, wenn der Zeitplan nicht eingehalten wird?

weitere Details in der Netzwoche

Haben Sie Fragen? Kontaktieren Sie Martin Schneider via E-Mail or via +41 44 814 2001.

3. Schuldschein: Helping SITA Rebuild the Airline Sector

When global air transport infrastructure provider SITA was seeking to extend its cash buffers, Germany’s Schuldschein market caught the eye of its Group Treasurer and Finance Director, Andrea Sottoriva. TMI talks with him about how issuing debt mid-pandemic has been a positive experience for all.

Similar to a traditional bond but less expensive, Schuldscheindarlehen (SSD), or promissory note loans, are privately placed instruments that do not need to be registered at a stock exchange. Although the Covid-19 pandemic has disrupted SSD issuance volumes, it is predicting the final tally for 2021 placements to exceed 2020’s Euro 19bn.

For Andrea Sottoriva, SSD has proven to be an excellent source of diversified financing. Unlike traditional bond issuance where all parties are informed, a Schuldschein placement invites only a select group of potential investors to participate.

The process involved Société Générale and UniCredit, who helped preparing the list of documents to communicate the SITA story to investors. As an unlisted firm and no official rating, it was important to explain SITA’s complex business model. While the two banks built a detailed Issuer Profile, SITA prepared an Investor package detailing its new three-year plan, a view of the impact of Covid-19 on its financials, and an explanation how it can help the wider air transport sector restart and restructure. The first investor call took place on 26 January 2021. With mid- to longer-term plans, it presented options of three-, five- and seven-year tenors to the wide range of mainly institutional investors invited by the organizing banks to virtually meet the SITA team.

Details on TMI (Treasury Management International) or at SITA’s site

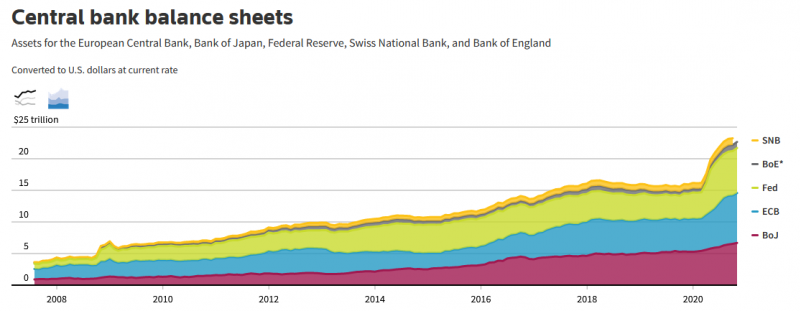

4. Central Banks Balance Sheet Growth and Inflation

A look at the development of the balance sheet totals of the five most important central banks shows an enormous increase in balance sheet totals. In the course of the financial crisis, the central banks put huge amounts of money into circulation to stimulate the economy.

European Central Bank ECB: The item refinancing loans to credit institutions on the assets side was initially "responsible" for the increase. Banks were suspicious and no longer lent money to each other. The ECB, therefore, provided the institutions with the money they needed, which they printed themselves. The next step was the ECB's bond-buying policy, which swelled the position of securities WZB.

The US Federal Reserve is pursuing a monetary policy that is leading to considerable growth, but also to high price increases. Steve Hanke, economics professor at Johns Hopkins University, expects an inflation rate of 5% in 2022 and almost 6% in the following two years. Only then inflation will subside. If the central bank floods the economy with so much money in one fell swoop, then asset prices rise first, after 6 to 12 months the economy booms, and 12 to 24 months later inflation finally shows up on a broad front.

The Central Bank tried to control the development of inflation expectations. According to Hanke, the price increase is not temporary and will not go away anytime soon. On the contrary: as soon as the Central Bank may lose control of inflation expectations, they they’ll face a problem and will suddenly have to react quickly if they really wanted to bring the inflation rate back to the officially targeted 2%. The only effective way to stop inflation is to limit the growth rate of the money supply.

Read more on the total assets of the other largest central banks in the world at the site tagesgeldvergleich.net

Ziehen Sie Deutsch vor? Hier der Bericht in der NZZ (Login allenfalls nötig)

Graph at Thomson Reuters with mouse over the graph of each central bank

5. Inflation: Does It Stay or Does It Disappear?

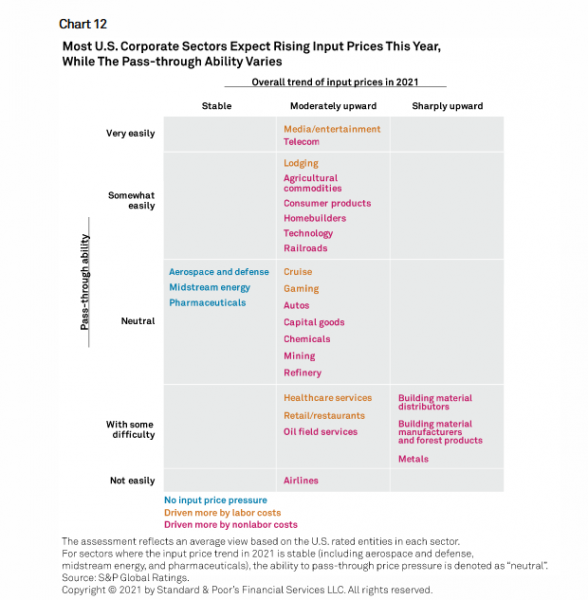

S&P Global Ratings' survey of rating analysts indicates that many U.S. corporate sectors are facing input price pressures this year, which are largely manageable through cost-saving measures, gains in productivity, or by passing them through to customers.

The forces behind the increase in input prices are varied, with the pandemic and associated recession among the most cited. For sectors such as media and entertainment, health care services, and retail and restaurants, there are costs of complying with COVID-19 protocols onsite – including sanitation and providing personal protective equipment. For others, there are supply-chain disruptions because of pandemic-induced production constraints, and the sudden demand uptick will increase input prices. For example, semiconductor shortages mean the auto industry could suffer a net loss of production of up to 3 million units this year (roughly 3%-5% of global production), testing automakers' willingness to pay higher prices for chips (see S&P Global - US Input Price Inflation, PDF 8 pages). Sectors such as consumer products are also seeing a surge in shipping costs.

Ziehen Sie Deutsch vor?

Notenbanker reden die steigenden Inflationsraten herunter mit der Botschaft: Es handelt sich nur um vorübergehende Korrekturen der extremen Ausschläge nach unten während Covid-19. Die Geldpolitik müsse locker bleiben und die Regierungen, die die Wirtschaft mit kreditfinanzierten Milliardenausgaben stimulieren, unterstützen, statt sie zu behindern. Aber was ist, wenn sich die Verantwortlichen irren?

Der Bericht in der Schweizer Finanz und Wirtschaft FuW vom 10.06.2021

6. Treasury Functions in Banking – the Driving Force Post-Covid

Isabella Sorace, Manager Treasury Transformation at PwC Switzerland, explains why in the recovery phase post-pandemic the treasury role is fundamental.

Treasury functions oversee liquidity levels and decide on the fund transfer pricing. Having access to data analytics, they can monitor the liquidity gap, define ad-hoc FTP prices and ensure that banks can support businesses in sectors that could be considered ‘unbankable’. With the right technology and data analytics, banks can take calculated risks and support the economy. It’s therefore imperative that treasuries adopt the best-in-class technology (starting from cloud adoption), which allows for fast and informed decision-making.

From this perspective, a cloud-enabled treasury function becomes a strategic function in the bank, and one of the key drivers of a quick economic recovery.

7. Wo lebt man in der Schweiz am günstigsten

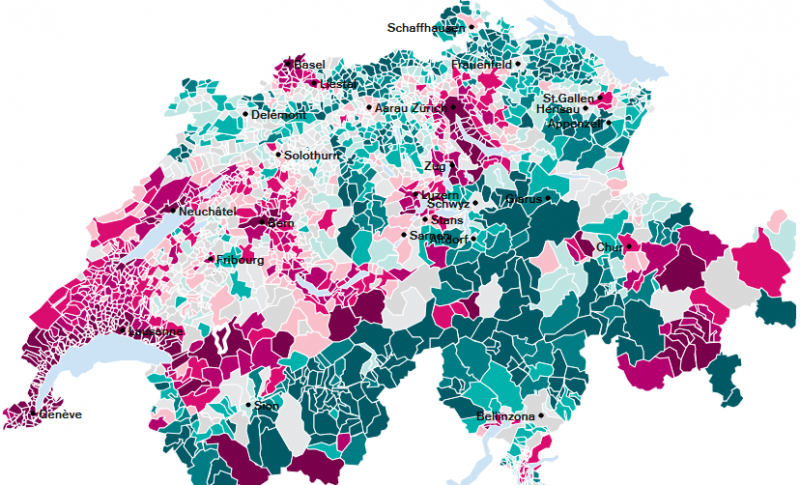

Klar ist, dass man auf dem Land günstiger lebt als in der Stadt. Aber auch ausserhalb der Zentren können schon wenige Kilometer Luftdistanz finanziell einen grossen Unterschied machen.

Anhand quantitativer Evidenz bewertet der von der Credit Suisse entwickelte RDI-Indikator (Regional Disposable Income) die finanzielle Wohnattraktivität der Schweizer Kantone und Gemeinden. Basis ist das geschätzte frei verfügbare Einkommen von mehr als 120’000 Beispielhaushalten pro Wohnort. Kleine Distanzen können relativ viel ausmachen.

Ein fiktives Beispiel mit 30% mehr frei verfügbares Einkommen: Angenommen, Herr und Frau Schmid und ihre zwei Kinder wohnen in Liestal (BL) in einer 100 Quadratmeter grossen Mietwohnung. Herr Schmid pendelt jeden Tag mit dem öffentlichen Verkehr zu seinem Arbeitsplatz in Basel, Frau Schmid arbeitet Teilzeit von zu Hause, während die Kinder in der Schule sind. Gemeinsam erzielen sie, inklusive Familienzulagen und Vermögensertrag, ein Bruttoeinkommen von 86 000 Fr. pro Jahr. Nach Abzug aller obligatorischen Abgaben und der Berücksichtigung der Miete, der Neben- und Elektrizitätskosten sowie der ÖV-Abonnements-Kosten für Herrn Schmid bleibt der Familie ein Betrag von 29 400 Fr. zur freien Verfügung.

Wenn nun Familie Schmid in eine vergleichbare Wohnung in Kaiseraugst (AG) zöge, würde sich ihr frei verfügbares Einkommen um rund 8900 Fr. auf 38 300 Fr. erhöhen (+30%).

Dafür verantwortlich sind primär die günstigere Miete und die tieferen Krankenkassenprämien. Derweil bleiben die Pendelzeit und die Mobilitätskosten von Herrn Schmid praktisch unverändert.

Zur Studie der Credit Suisse mit einer Interessanten Mouse over Schweizer Landkarte. Wählen Sie Ihren Familienstand Ledig, Verheiratet, Rentner, Verheiratet, 2 Kinder, Verheiratet, 2 Kinder KiTa.

8. Book Tip – Digital Body: How to Build Trust & Connection, No Matter the Distance

This book by Erica Dhawan, a global leadership expert, is a practical guide to the ways in which we need to rethink how we interpret behavior in the digital world. Developing a common digital body language will help everyone while opening a path to better ways to relate to one another and create a sense of inclusion and belonging.

The book is especially relevant now in a business world turned upside down by video calls, group texts, and remote work. With expert guidance, one can learn how to read and send the subtle cues that signal trust, competence, and authenticity. Filled with lively and entertaining examples of real conversations, the book offers the tools to understand what can go wrong in communication and to find a common language in which to strengthen relationships at work and at home.

- 15.6.2021 von 13:00 bis 17:0 Uhr: Cash Management Campus, Web-Conference von DerTreasurer und BNP

- 15.-16.6.2021: Future Branches Connect, virtueller Event

- 15.-17.6.2021: Fintech Spring Meetup, Web-Conference

- 22.-24.6.2021: Regulatory Compliance Conference, virtuelle Conference

- 20.10., 27.10, 3.11.2021 jeweils von 09:15-17:15 Uhr: IFZ Fachkurs Swiss Treasury Practice Aktuelle Herausforderungen im Corporate Treasury von Hochschule Luzern

- 9.9.2021 ganztags: Swiss Treasury Summit 2021 von der Hochschule Luzern auf dem Campus Zug-Rotkreuz

- 6.-8.10.2021: 35. Alpbacher Finanzsymposium, live event

- Ab 18.11.2021: Lehrgang Certified Corporate Treasurer VDT 2021 und 2022 (Verband Deutscher Treasurer).

Der Lehrgang umfasst vier Module à drei Tage, jeweils von Donnerstag bis Samstag sowie ein Modul à vier Tage, von Mittwoch bis Samstag, pro Seminartag acht Unterrichtseinheiten à 45 Minuten.

Der Lehrgang findet in den Räumen der Frankfurt School of Finance & Management, Frankfurt am Main statt.

Modul 1: 18.11. - 20.11.2021

Modul 2: 20.01. - 22.01.2022

Modul 3: 03.03. - 05.03.2022

Modul 4: 04.05. - 07.05.2022

Modul 5: 23.06. - 25.06.2022

Spannende, interessante Interviews bieten mir immer wieder die Sendungen „Sternstunde“ am Schweizer Fernsehen. Vor rund einem Jahr während des grössten Lockdowns ergab sich für Barbara Bleisch das Interview mit Bertrand Piccard - dem Piloten, Psychiater und Abenteurer, der mit Solar Impuls die Welt umrundete. Bertrand Piccard stammt aus der bekannten Forscher Familie der Piccards.

Zu Covid angesprochen sagt Betrand Piccard: «Eine Krise die man ablehnt - bleibt eine Krise», hingegen „Eine Krise, die man annimmt - ist ein schöpferisches Abenteuer“. Die Minute 38:30 des Interviews beschreibt, wie man sich verändern kann und was es bedeutet, die Flughöhe zu ändern und sich Neuem anzupassen. Dennoch gibt es weiterhin Menschen, Parteien, Regierungen, die in die gute alte Zeit zurückwollen.

Die Welt war vor Covid-19 auch instabil, ungerecht, gefährlich oder verschmutzt. Eine stabile Welt zu verändern, ist aufwändiger als in der Krise die Chance zu nehmen und sich neu zu orientieren.

Für die Veränderung unserer Welt brachte Bertrand Piccard zwölf führende CEOs an den Tisch, wie von Nestle, Louis Vuitton, BNP, die sich verpflichten mitzuarbeiten.

Link zum YouTube Interview 55 Minuten in Deutsch

or watch in English language alternately this speech of Bertrand Piccard 27 Minutes. The most impressive thing for me is what Bertrand Piccard wanted to prove.

Enjoy, Martin and the Tomato Team