Locating All Liquid Assets and Liquidity Planning

Our method of identifying liquid assets and liquidity planning allows you to optimally monitor all your liquid assets. This will help you to increase managerial flexibility and enable you to repay bank loans. Together with you, we can enhance the visibility of your accounts with cash status and plan your assets short, mid-, or long-term. With or without cash pool!

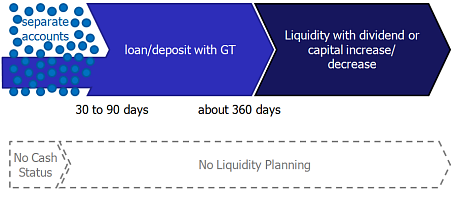

Without Cash Status, Cash Pool and Cash Forecast

For many accounts, liquidity is not fully or not in time visible or usable by the Group Treasury so that it may not be available for investments.

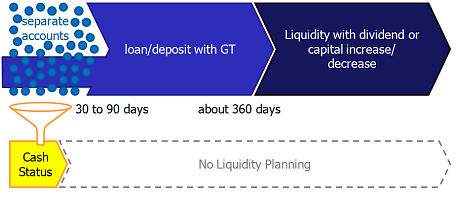

With Cash Status

Your worldwide bank accounts are visible, but planning/forecasting is inadequate. Therefore you may miss opportunities such as repayment of bank loans.

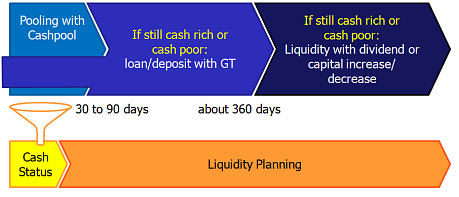

With Pooling and Liquidity Plan

Pooling of major currencies allows accessing money quickly. Also your liquidity is pooled at fewer bank accounts (see our page on banking-relations). A liquidity plan allows you to make use of opportunities and manage your worldwide liquidity.

In a pool, daughter companies are to monitor their liquidity in the pool. Certain country legislation require this. A cash pool should only include top short-term cash positions and short-term liquidity. The major liquidity is transferred as before via short-term inter-company deposits and loans. These loans underlie a normal credit contract. Therefore daughter companies have low risk that their liquidity might be misused.

Questions? Ask for our documentation.